Welcome to the 127th edition of The CTO Show Brief!

This week’s issue reflects a region in transition. While MENA startup funding dropped sharply in June, the broader picture is more layered. Africa is showing strong signs of recovery, Türkiye’s ecosystem continues to mature, and UAE-based deeptech companies are making global headlines. Investor caution is evident, especially with the rise of debt financing, but innovation is far from slowing down. From smart lenses to freight-tech, standout deals continue to emerge. On the global front, AI is no longer just a feature — it’s becoming the foundation of the entire tech stack. The race is now about infrastructure, capital, and geopolitical strategy.

Whether you’re one of our 2,680 subscribers or a first-time reader—grab your coffee, and let’s dive into what’s shaping tech and venture this week!

MEA Tech Momentum

Industry Reports

In June 2025, MENA startups raised only $52 million across 37 deals, marking an 82% month-on-month decline and a 55% drop compared to June 2024, with 40% of the capital coming through debt instruments, reflecting cautious investor sentiment. The UAE led with $37 million raised by 13 startups, followed by Tunisia breaking into the top three with a $3.5 million seed round for Kumulus, a water generation startup, while fintech dominated with 74% of total capital. Read More

African startups raised $1.2 billion in the first half of 2025, marking an 86% increase from H1 2024, with significant growth in sectors like fintech, cleantech, and emerging areas such as PropTech, driven by larger and more varied investments. Key countries like South Africa, Egypt, and Senegal saw substantial funding, with notable deals including Wave’s $137 million debt facility in Senegal, reflecting a maturing and rebounding African tech ecosystem. Read More

Turkish startups raised $211 million across 91 funding rounds in the first half of 2025, showing growth aligned with global trends and focusing on key sectors like fintech, gaming, and AI. This investment volume highlights the strengthening of Türkiye's startup ecosystem, with increased deal activity compared to previous periods. Read More

Startup Funding and Investments

BioSapien, a UAE and US-based healthtech startup, has extended its pre-Series A funding to over $8 million, with new investor Globivest, a women-led venture capital fund from the MENA region specializing in Life Sciences, joining existing backers Global Ventures, Golden Gate Ventures, and Dara Holdings. The funding will support the development and global expansion of BioSapien’s flagship product, MediChip™, a 3D-printed, slow-release drug delivery platform for localized cancer treatment, and has facilitated the hiring of 12 new executives across R&D, medical affairs, regulatory, and operations. Read More

Khetika, a Mumbai-based healthy food startup founded in 2017, raised USD 18M from investors including Anicut Capital to expand its preservative-free, clean-label food products into the MENA, Europe, and US markets. The company, which sources directly from farmers across 14 Indian states, plans to launch new products and set up additional manufacturing facilities with the funding. Read More

TruKKer, a Saudi Arabia-based digital freight network founded in 2016, has secured a $15 million private credit investment from Ruya Partners to support its regional expansion and enhance its technology capabilities across 9 countries, connecting 60,000+ transporters with 1,200+ enterprise clients. This funding aims to solidify TruKKer’s position as a leading freight-tech platform in the Middle East, North Africa, and Central Asia, building on its previous $100 million pre-IPO round in 2022. Read More

Cerebrium, a South African AI startup founded in Cape Town and now headquartered in New York City, has raised $8.5 million (R151.35m) in seed funding led by Google’s AI venture fund Gradient, to scale its serverless AI infrastructure platform that simplifies building and scaling multimodal AI applications. The funding will enable Cerebrium to invest in new features and meet growing enterprise demand, positioning it to power innovative AI companies like Tavus and Deepgram with its high-performance platform for real-time applications such as voice agents and large-scale data analytics. Read More

Saudi-based SaaS startup Rekaz raised $5 million in seed funding, led by COTU Ventures with participation from Impact46, Shorooq Partners, Numrah Capital, and angel investors, to expand its all-in-one platform for service-based SMBs like gyms, salons, and clinics, which streamlines scheduling, payments, subscriptions, and customer engagement. The funding will support product development, AI enhancements, and expansion across GCC markets, aiming to provide foundational infrastructure for businesses traditionally underserved by software solutions. Read More

Dubai and Madrid-based proptech company Huspy raised $59 million in a Series B funding round led by Balderton Capital, with participation from Peak XV and others, to expand its mortgage platform across Europe and the Middle East, bringing its total funding to over $100 million. The funding will support European expansion, technology investment, and strategic hiring, with plans to operate in over 10 cities by the end of 2025 and enter Saudi Arabia this year, enhancing its platform that facilitates over $7 billion in annual real estate transactions and serves stakeholders like mortgage brokers and real estate agents. Read More

icogz, a UAE-based business intelligence platform founded in 2018, raised $1.4 million in pre-seed funding from angel investors in the UAE and India to enhance product development and expand its Aryabot AI engine in the MENA and Southeast Asia regions. The funding will also support go-to-market efforts, aiming to scale its modular agent stack across enterprise functions for future Series A round preparations. Read More

Mubadala Investment Company is in advanced talks to acquire an additional $100 million stake in Revolut, following its initial investment during a secondary share sale in August 2024, aiming to strengthen its position in the UK-based fintech valued at approximately $45 billion. This investment aligns with Mubadala’s strategy to increase exposure to high-growth European tech companies and position Abu Dhabi as a global fintech hub, supporting Revolut’s expansion into the Middle East and Asia. Read More

UAE-based deeptech startup XPANCEO raised $250 million in Series A funding at a $1.35 billion valuation, led by Opportunity Venture (Asia), to advance its multifunctional smart contact lens integrating AR, health monitoring, and other features. The funding will support commercialization, global R&D expansion, and regulatory approvals, aiming to replace multiple personal gadgets with a single wearable device. Read More

Saudi fintech Tarmeez Capital, founded in 2022 and licensed by the Capital Market Authority, has raised a strategic funding round led by Tali Ventures, the corporate VC arm of stc group, to scale its platform that streamlines sukuk issuance at 7x the speed of traditional methods and supports over 180,000 users with accessible Islamic finance. The investment aligns with Vision 2030 financial inclusion goals, aiming to expand retail sukuk access and leverage technology to connect finance-seeking businesses with investors, amidst a rapidly growing Saudi corporate debt market reaching SAR 140 billion in 2024. Read More

BlueFive Capital, a UAE-based investment platform founded by Hazem Ben-Gacem, closed its Founding Shareholders Circle round at a $120 million valuation, attracting 25 founding shareholders including prominent GCC royal families and finance leaders from North America, Europe, and Asia. Since its launch in late 2024, the firm has grown to manage over $650 million in assets under management with a global team, aiming to bridge institutional platforms with high-growth markets using the GCC as a launchpad. Read More

Acquisitions and Mergers

Nawy, an Egypt-based proptech startup, has acquired a majority stake in Dubai-based SmartCrowd, a fractional real estate investment platform regulated by the Dubai Financial Services Authority (DFSA), marking Nawy's entry into the GCC market. This acquisition, following Nawy's $75 million Series A fundraise, expands Nawy's offerings to include fractional ownership and aims to position it as a real estate super app in the MENA region, leveraging SmartCrowd's platform that has facilitated $110 million in transactions since 2018. Read More

Saudi-listed food delivery platform Jahez is acquiring a 76.56% stake in Qatar’s Snoonu for $245 million, valuing Snoonu at $320 million and marking Jahez’s entry into the Qatari market and further expansion across the GCC. The transaction, funded from Jahez’s existing cash reserves, bank facilities, and treasury shares, includes acquiring 75% of Snoonu’s shares for $225 million in cash and shares, plus subscribing to newly issued shares for an additional $20 million. Read More

Expansions and Market Entries

Egyptian fintech Valu has received initial regulatory approval from Jordan’s central bank to launch its Buy Now, Pay Later (BNPL) service, marking its first expansion outside Egypt and supported by recent developments like a listing on the Egyptian Exchange and an investment from Amazon. This expansion is part of Valu’s strategy to become a key player in digital consumer finance across the Middle East, with plans already in place including hiring local leadership and forming partnerships in Jordan. Read More

Leta, a Kenyan software startup that builds logistics software for businesses, has expanded into Ghana, its seventh market, after securing a $5 million seed round led by Speedinvest with participation from Google's Africa Investment Fund, Equator, and others. The expansion follows significant growth metrics, including a 5x increase in revenue, 4.5 million deliveries completed, and over 150,000 tonnes of goods moved, positioning Leta for Pan-African dominance in supply chain optimization. Read More

LemFi, a London-based international payment services startup, has expanded its low-cost remittance services to Egypt, its 31st destination, targeting the country's significant remittance market (estimated at $20.6-29.6 billion in 2024) by offering zero transfer charges and market-tracking FX rates to Egyptians abroad. This move, supported by $53 million in Series B funding and the acquisition of a UK card issuer, completes LemFi's rollout in North Africa, now serving over two million users across Morocco, Tunisia, and Egypt, with plans to integrate card services and multicurrency wallets.(Wamda) | (Techpoint Africa)

🌍 Global Tech & VC Pulse

This week marks a critical inflection point as Artificial Intelligence shifts from a feature to the fundamental organizing principle for the entire tech industry. The market is being violently reshaped by a race to own AI infrastructure, a bifurcation of capital into mega-deals, and profound social and geopolitical friction.

Hardware Arms Race: US vs. China

The battle for AI supremacy is being fought at the hardware level, with governments using policy as a weapon and key companies facing diverging fortunes in the race to produce the most advanced chips.

United States

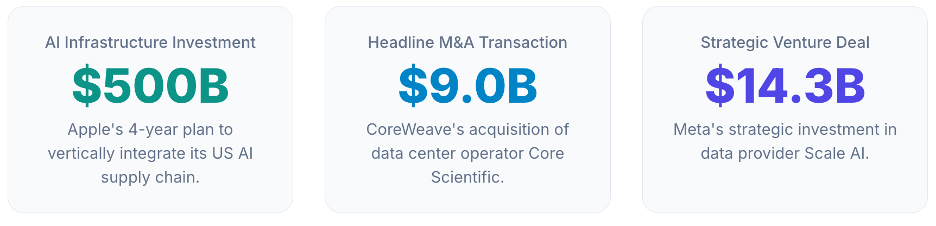

Apple launches $500B plan for US-based AI chip manufacturing and data centers.

TSMC identified as the "undervalued backbone" of the AI revolution.

US plans to restrict AI chip exports to Malaysia and Thailand to close loopholes for China.

China

Huawei Cloud launches Pangu 5.5 models, claiming 95% accuracy improvements in NLP.

Samsung faces profit drops and delays in supplying crucial HBM chips.

China and Brazil sign MOU for AI and infrastructure collaboration.

The AI Hyperscaler Land Grab

The week's largest M&A event vividly illustrates the new infrastructure land grab. This vertical integration strategy aims to de-risk future expansion and control the rising costs of energy and specialized data center space, signaling a maturation of the AI industry.

This acquisition gives CoreWeave ownership of ~1.3 GW of power and potential for 1 GW more, eliminating over $10B in future lease overhead.

Capital Flows: Funding the Future

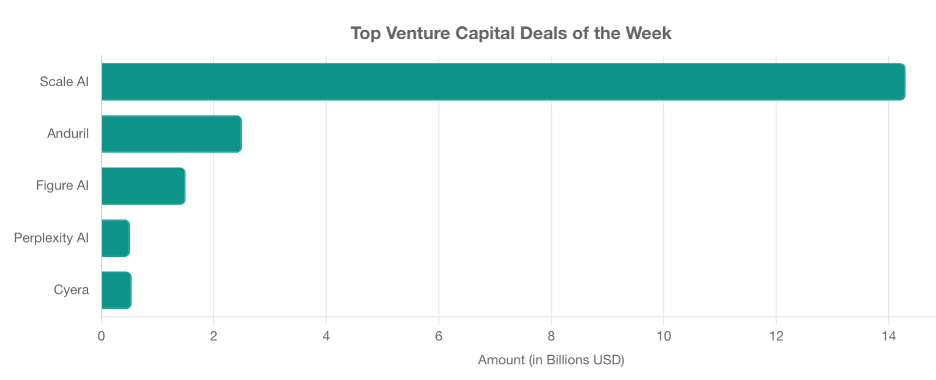

This week's data reveals a market of extremes: an unprecedented concentration of capital into a few massively valued AI leaders, alongside a vibrant, selective ecosystem for early-stage innovation in applied AI, deep tech, and life sciences.

Market Impact: People, Policy, and Products

The AI transformation is creating profound social and geopolitical friction, from massive workforce displacement to a fragmented global regulatory landscape and a new focus on AI in consumer products.

The Great Crew Change

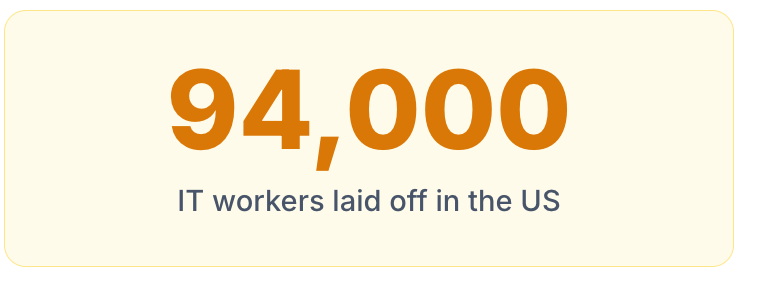

Major tech firms laid off workers to reallocate funds to AI, creating a starkly bifurcated labor market.

While some roles are devalued, those with specialized AI skills are commanding an unprecedented premium.

🎙️Episodes Recap:

In this episode of The CTO Show, Mehmet Gonullu sits down with Cosmin Ivan , CEO of Platinumlist, the leading event and ticketing platform in the MENA region. From selling tickets by hand to building a platform used for the biggest concerts and sporting events, Cosmin shares his 18-year journey and how Platinumlist became a trusted tech partner for global entertainment brands.

In this episode, Mehmet sits down with Mauro Battellini, co-founder of Black Unicorn PR, to break down why PR is no longer optional for startups—and how the rise of AI-powered search is changing what investors and customers see first.

From fundraising strategy to media perception, Mauro explains how to build legitimacy, earn visibility, and outperform better-funded competitors—even if you’re not in Silicon Valley.

In this episode, I sit down with Greg Marlin , the CTO of ZKcandy, to explore the evolving intersection of AI agents, blockchain infrastructure, NFTs, and the gaming world. We dive deep into how Greg is building seamless onboarding for Web3 gaming, how AI agents are redefining non-player characters and companions, and why encrypted AI agent NFTs might just be the future of user-owned digital experiences.

Let’s Stay Connected

💡 New: Join the Community I’m Building

I’m launching a new founder–operator–investor community focused on B2B tech, deeptech, and cross-border growth between emerging markets and global hubs.

📚 We’ll share GTM learnings, insights from deals, and trends from MEA to the US.

🎤 Events, best practices, and opportunities to learn from each other.

🌍 If you’re a builder or backer who wants to stay ahead of the curve, this is for you.

Thanks for reading — and for being part of this growing, global-minded network.

— Mehmet