Welcome to the 128th edition of The CTO Show Brief!

As the global venture landscape consolidates around high-barrier, high-impact plays in AI, defense tech, and automation, the MENA region is quietly building its own surge. From Saudi Arabia’s record AI funding in customer experience to Morocco’s superapp expansion and Egypt’s fintech nudges, the week saw a flurry of strategic moves across the region. Meanwhile, African startups double down on edtech and crypto utility, and Turkey and Uzbekistan push deeper into AI infrastructure. As global capital sharpens its focus on national priorities and regulatory agility, what’s brewing in MENA and adjacent markets is no longer fringe—it’s foundational.

Whether you’re one of our 2,684 subscribers or a first-time reader—grab your coffee, and let’s dive into what’s shaping tech and venture this week!

MEA Tech Momentum

MENA Startup Funding

Lucidya (AI Customer Experience, MENA): Lucidya, a leading AI-Powered customer experience management platform in MENA, has raised USD30 million in its Series B funding round, marking the largest AI investment in the region, led by Impact46 with participation from Wa’ed Ventures, Takamol Ventures, SparkLabs, Rua Growth Fund, and ARG. The funding will help Lucidya scale its AI Agent offering, targeting the rapidly growing CRM/CX software market in MENA, projected to reach USD9 billion by 2030, and enhance its proprietary Arabic-language AI engine with over 92% accuracy. Read More

Yasmina (Insurtech, Saudi Arabia): Saudi insurtech Yasmina, founded in 2023 by Masoud Alhelou and Bashar Abalkhail, has raised $2 million in a seed round led by Scene Holding, with plans to expand operations to the UAE in 2025 and Egypt in 2026, focusing on offering personalized, API-driven insurance products. The funding will support scaling beyond Saudi Arabia, enhancing its embedded insurance platform that integrates with digital platforms to provide medical, motor, life, and general insurance at checkout, fully regulated and ready in under 48 hours. Read More

Wittify.ai (Conversational AI, Saudi Arabia): Wittify.ai, a Saudi Arabia-based conversational AI startup founded in 2025, raised $1.5 million in a pre-seed round to enhance its Arabic-first AI platform, which supports over 25 Arabic dialects and integrates with various business systems. The funding will support product development, team expansion, and market expansion efforts across the MENA and GCC regions. Read More

PALM (Fintech, Egypt): Egypt-based fintech startup PALM, founded in 2024, has raised a 7-figure pre-seed funding round led by 4DX Ventures, with participation from Plus VC and international angel investors, to expand its product and user base in the Mediterranean region. PALM offers a platform that combines smart nudges, embedded finance, and curated investments across fixed income, equities, and precious metals to help users save for life goals, alongside exclusive merchant deals to enhance savings value. Read More

ORA Technologies (Superapp, Morocco): Moroccan superapp ORA Technologies, founded in 2023 by Omar Alami, has closed its Series A funding round at a record $7.5 million, led by Azur Innovation Fund and joined by three strategic local investors, bringing its total local fundraising since January 2023 to $11.9 million. The funding will support ORA's expansion of last-mile operations and enhancement of its digital cash collection infrastructure, leveraging its multiple features including P2P transactions, e-commerce, on-demand services, chat functionality, social networking, and an upcoming digital wallet. Read More

Ovasave (Femtech, UAE): UAE-based femtech startup Ovasave, supported by Abu Dhabi’s Hub71, has raised $1.2 million in pre-seed funding to expand its fertility and hormonal health platform into Saudi Arabia and across the GCC, focusing on scaling corporate partnerships and enhancing its mobile app. Founded in 2023, Ovasave offers digital-first solutions including at-home hormone testing, virtual consultations, and personalized supplement protocols, aiming to address women’s health needs in a region where the FemTech market is projected to reach $3.8 billion by 2031. Read More

African Startup Funding and Developments

MoneyBadger (Crypto Payments, South Africa): South African crypto payments provider MoneyBadger has secured $400,000 (R7 million) in pre-seed funding, led by P1 Ventures and three angel investors, to enhance Bitcoin and crypto adoption among merchants in South Africa and potentially expand to other African markets. The funding will also support team growth and partnerships with large retailers, e-commerce payment gateways, and QR-based payment networks, aiming to make Bitcoin payments accessible at over 1,600 outlets, including all Pick n Pay stores. Read More

Nigerian Diaspora EdTech Startups: Nigerian diaspora edtech startups like Lingawa, Schollarr, Tuteria, Afrilearn, Izesan!, Gradely, Klas, Dexude, Educare, and Funda are leveraging AI and innovative platforms to enhance global education access, particularly focusing on African languages, digital skills, and personalized learning for students in underdeveloped and developing regions. These startups, founded by entrepreneurs such as Frank Akinwande Williams and Tersoo Hulugh, have achieved significant milestones, including serving hundreds of thousands of learners, connecting students to global mentors, and earning recognition from organizations like EdTech Africa and the United Nations. Read More

Emerging Markets Funding (Beyond MEA)

Virgosol (AI Software Testing, Turkey): Virgosol, a company developing AI-focused products in software testing, received a $3.5 million investment from Revo Capital, one of Turkey's largest technology-focused venture capital funds, to enhance its global presence and develop its AI-driven software testing platform RabbitQA. The investment aims to double Virgosol's international market presence within two years and position it to create new global standards in software quality by 2027, while also boosting Turkey's presence in the global software market. Read More

TASS Vision (AI Computer Vision, Uzbekistan): Uzbek startup TASS Vision, founded in 2021 and specializing in AI-powered computer vision, raised USD 1.5 million led by Purple Ventures to expand into the MENA region and Central Eurasia, while also developing new AI camera hardware for retail. The funding round included contributions from several regional investors, and TASS Vision's products focus on on-device AI tools for in-store behavior analysis, prioritizing customer privacy. Read More

VC and Ecosystem News

Sukna Capital (Direct Lending Fund, Saudi Arabia): Sukna Capital, based in Saudi Arabia, has launched the first open-ended direct financing fund, the Sukna Fund for Direct Financing (SFDF), approved by the Capital Market Authority, to provide non-dilutive, sharia-compliant capital to SMEs, addressing the region's under-penetrated SME lending market. The fund, targeting high-potential sectors like technology and healthcare, uses proprietary technology for managing origination and risk, and is part of Sukna’s expansion into structured private debt, complementing its venture arm, Sukna Ventures, which supports startups in mobility, logistics, and digital marketplaces. Read More

Saudi Arabia VC Rankings: Saudi Arabia led venture capital activity in the Middle East and North Africa in early 2025, raising $860 million with a 116 percent annual increase, supported by sovereign capital and foreign interest, while also ranking second among emerging venture markets globally, behind only Singapore. Additionally, the Saudi Data and Artificial Intelligence Authority signed a deal with the Private Sector Partnership Reinforcement Program to boost AI-driven innovation, aligning with Vision 2030 goals to enhance the private sector's contribution to GDP and position the country as a global AI hub. Read More

A15 (VC Firm, Egypt): Egyptian early-stage venture capital firm A15 has achieved over 10x returns on its inaugural Fund I, marking a significant milestone as it celebrates its tenth anniversary, with notable exits including TPAY Mobile’s acquisition by Helios Investment Partners and Connect Ads’ acquisition by Aleph Group. The firm, founded in 2015, supports its portfolio of 40 active companies across nearly 20 MENA countries with deep operational involvement, aiding in scaling and market expansion. Read More

ADQ-Linked Group (Fintech Launch, UAE/Turkey): ADQ, Abu Dhabi’s sovereign fund, has partnered with Turkey’s Trendyol Group, Baykar CEO Haluk Bayraktar, and China’s Ant International to potentially launch a new fintech platform in Turkey, offering services like digital payments, loans, deposits, investments, and insurance to individuals and small businesses. This development aligns with Turkey’s growing digital economy, which saw a significant increase in startup transactions and values in 2024, with 331 deals worth $2.6 billion compared to 297 deals worth $497 million in 2023. Read More

Entlaq Cleantech Report (Egypt): Entlaq, in collaboration with the Ministerial Group for Entrepreneurship and the Ministry of Planning, Economic Development, and International Cooperation, launched a national report titled “Cleantech and Energy in Egypt 2025”, providing a comprehensive analysis of Egypt’s cleantech ecosystem, focusing on EnergyTech and WaterTech, amidst growing global and regional investments in clean energy. The report highlights Egypt’s potential to lead in green innovation, identifying barriers such as regulatory fragmentation and limited green finance, and proposes reforms like a dedicated cleantech startup law and increased financial incentives to position Egypt as a regional hub for sustainable technology. Read More

500 Global Expansion (Abu Dhabi): 500 Global is expanding into Abu Dhabi with a plan to invest up to $300 million over the next two years in startups addressing challenges in emerging markets like Africa, Brazil, the Gulf, and India, focusing on areas such as climate adaptation and digital infrastructure. The firm has appointed Dr. Alaa Murabit, a former Gates Foundation executive, to lead its new Sustainable Growth practice, aiming to increase co-investments with sovereign wealth funds and governments, aligning with national priorities like Saudi Arabia’s Vision 2030. Read More

Acquisitions and Reacquisitions

Tactful AI (AI Customer Experience, Egypt): Tactful AI, an Egypt-born AI startup focused on customer experience management, has been reacquired by its founders Mohamed El-Masry and Mohammed Hassan from Belgian firm Dstny, aiming to pursue independent growth with a focus on expanding in Saudi Arabia, the UAE, and Western Europe. The company, founded in 2016, has invested over $5 million in developing its AI technology, enabling enterprises to manage digital customer interactions in real time and boost digital revenues by 15–35% within months of deployment. Read More

PlayAI (Voice AI, Egyptian Founder): Meta has acquired PlayAI, a US-based voice AI startup founded by Egyptian engineer Mahmoud Felfel, which specializes in advanced conversational AI models like Play Dialog and recently launched Playnote, aligning with Meta’s strategy in AI development. The acquisition, with undisclosed financial details, includes the entire PlayAI team joining Meta to enhance its capabilities in AI characters, Meta AI, wearables, and audio content creation, amidst competition with OpenAI and Google. Read More

🌍 Global Tech & VC Pulse

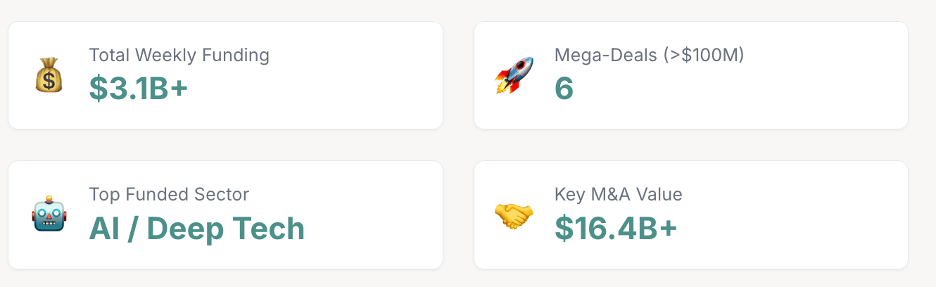

This week's venture landscape was dominated by a surge in mega-deals, particularly in the AI and Deep Tech sectors. Strategic M&A continues to shape the infrastructure backbone, while capital consolidates around market leaders, signaling strong investor confidence in transformative technologies.

📊 Global Tech & Capital Signals – Week of July 14, 2025

· AI-Driven Capital Flows Intensify

o Global VC funding hit $91B in Q2 2025 (+11% YoY), with ~1/3 going to just 16 mega-deals.

o AI alone absorbed 45% of global venture capital—marking a clear consolidation of funding into select innovation hubs.

· Public Policy Now Moves Markets

o The “One Big Beautiful Bill” (OBBB Act) is reshaping investment logic with 100% expensing for R&D/equipment and aggressive funding for domestic AI and semiconductor infrastructure.

o Companies must now navigate geopolitical compliance as a strategic imperative—supply chain transparency and foreign entity screening are non-negotiable.

· Crypto Goes Institutional

o Bitcoin surged past $122K as the U.S. moved toward clear digital asset regulation.

o Stablecoin rules now link reserves to U.S. Treasuries—cementing crypto within the broader financial system and attracting conservative capital.

· The Barbell Effect in Venture

o Mega-rounds dominate one end; small, thematic, often government-backed seed funds occupy the other.

o Mid-stage software and consumer tech startups face a tough climb, with rising pressure for efficiency or consolidation.

· IPO Market Rekindles – Selectively

o U.S. remains the top listing venue, with 62% of H1 IPOs coming from foreign firms.

o Strong aftermarket performance from names like Chime and CoreWeave is helping re-open the window.

· Strategic M&A Reshapes the Landscape

o $35B Synopsys–Ansys merger showcases the push toward full-stack, system-level tech solutions.

o High-value capability buys continue: Cognition/Windsurf, Zendesk/HyperArc, IBM/Hakkoda, Zimmer Biomet/Monogram.

· Enterprise AI Is the Real Battleground

o The shift is from general models to domain-specific tools (e.g., Devstral, MedGemma).

o AI now lives in workflows: Microsoft Copilot, Google Workspace Gems, Perplexity’s AI browser.

· Crosswinds in Global Regulation

o U.S. policy focuses on reshoring and supply chain integrity.

o The EU prioritizes ethical AI and environmental compliance.

o Navigating this fragmented compliance matrix favors companies with regulatory agility and deep operational discipline.

· New Capital Formation Themes

o Momentum is shifting from generalist funds to geographically and sector-focused strategies.

o Recent launches: $175M Galaxy crypto fund, $60M Michigan Innovation evergreen fund, and targeted regional initiatives for women- and minority-led firms.

· Defense Tech, Vertical AI, and Automation in Focus

o Top deals reflect a clear pattern: Bedrock Robotics (heavy construction), Firestorm (autonomous drones), Hadrian (defense manufacturing), OpenEvidence (AI for physicians).

o These are high-capital, high-barrier plays aligned with long-term infrastructure and national priorities.

🎙️Episodes Recap:

#496 From Accidental Founder to 30,000+ Entrepreneurs | Jeremy Ames on Building Businesses That Last

In this episode of The CTO Show with Mehmet, we sit down with Jeremy Ames, Co-Founder and CEO of Guidant Financial, a company that has helped over 30,000 entrepreneurs fund their businesses using US retirement funds. Jeremy shares his unconventional path into entrepreneurship, the rise of Main Street innovation, and what truly holds people back from launching businesses

Raj Singh , VP of Product at Mozilla and a seasoned startup founder, joins The CTO Show with Mehmet to share a candid look into the evolution of building products—from the early days of AI to today’s GenAI-fueled solo founder wave. We dive into what vibe coding means, how big companies like Mozilla are tackling zero-to-one innovation, and why most startups fail—not because of the idea, but because the founders get tired.

Let’s Stay Connected

💡 New: Join the Community I’m Building

I’m launching a new founder–operator–investor community focused on B2B tech, deeptech, and cross-border growth between emerging markets and global hubs.

📚 We’ll share GTM learnings, insights from deals, and trends from MEA to the US.

🎤 Events, best practices, and opportunities to learn from each other.

🌍 If you’re a builder or backer who wants to stay ahead of the curve, this is for you.

Thanks for reading — and for being part of this growing, global-minded network.

— Mehmet