Welcome to the 129th edition of The CTO Show Brief!

From Dubai to Dakar, the MEA region is heating up with bold startup bets and sovereign-scale moves—from Qlub’s $30M Series B powering restaurant tech to Oman’s $4.1B sovereign push into AI and renewables. Meanwhile, global tech is undergoing a seismic reset: the U.S. “AI Action Plan” is redrawing innovation lines, venture capital is polarizing around a few AI giants, and M&A is being reshaped by vertical AI grabs. Whether you’re tracking GCC fintech waves or global industrial policy shifts, this issue delivers sharp insights at the intersection of capital, code, and geopolitics.

Whether you’re one of our 2,685 subscribers or a first-time reader—grab your coffee, and let’s dive into what’s shaping tech and venture this week!

MEA Tech Momentum

Startup Funding Rounds

Journify (Dubai, Marketing Tech): Dubai-based marketing startup Journify has raised strategic funding from Shorooq Partners, Bunat Ventures, and Plug and Play, doubling its valuation and achieving 5x revenue growth over the past six months, to expand its AI-powered first-party data activation platform across the MENA region, particularly in Saudi Arabia, the UAE, and the broader Gulf. The company, founded in 2023, helps brands leverage customer insights for advertising on platforms like Meta, TikTok, and Google, addressing challenges such as stricter privacy regulations and the phasing out of third-party cookies, while planning to advance its AI product roadmap and strengthen its presence in key GCC markets. Read More

Flend (Egypt, Fintech): Egyptian fintech startup Flend has raised $3 million in a seed funding round, combining equity and debt, to expand its embedded SME lending platform, which integrates with platforms SMEs use, such as B2B marketplaces and supply chain systems, enhancing access to capital in Egypt’s underserved small business sector. The funding, led by Egypt Ventures with participation from Camel Ventures, Sukna Ventures, Plus VC, Banque Misr, and others, aims to address Egypt’s $50 billion SME financing gap by injecting over $20 million in working capital loans, aligning with regional efforts to digitize financial services for emerging markets. Read More

Qlub (Dubai, Fintech): Dubai-based fintech startup Qlub, which digitizes restaurant payments, raised $30 million in Series B funding co-led by Shorooq Partners and Cherry Ventures, with participation from e&, Mubadala Investments, and Legend Capital, to expand globally and enhance its QR-based payment platform used by over 3,000 restaurants across multiple markets including the UAE, Saudi Arabia, and the US. The funding will support Qlub’s geographic expansion and product development, aiming to integrate further with hospitality platforms and position itself as key infrastructure for the restaurant industry’s digital transformation in emerging markets. Read More

ZabonEx (Oman, Predictive Analytics): ZabonEx, an Oman-based predictive analytics startup founded in 2023, has raised $100,000 in pre-seed funding to enhance its B2B SaaS platform that helps F&B businesses optimize inventory and reduce waste through real-time demand forecasting. The company plans to use the funds to improve its predictive engine, expand its tech team, and build strategic partnerships in Oman’s food supply chain, while also preparing for regional expansion in emerging markets. Read More

Lime Consumer Finance (Egypt, Fintech): Lime Consumer Finance, backed by First Abu Dhabi Bank Group, has launched in Egypt with a $9.4 million investment, focusing initially on educational financing through its app to support families with accessible payment plans. The app, licensed by Egypt’s Financial Regulatory Authority, aims to expand into other essential life sectors, leveraging technology to enhance financial inclusion in Egypt’s fintech landscape, particularly relevant for emerging markets with a young population. Read More

Occupi (US/Turkey-Reported, Fintech): Women-founded fintech startup Occupi, based in Birmingham, Alabama, has raised $3.1 million in seed funding for its AI-based platform that simplifies rent payments in the US, offering over 20 payment options including digital wallets like Cash App and Venmo, targeting underserved tenants and property owners to promote financial inclusion. The investment, led by Fenway Summer and Assurant Ventures, will support team expansion and partnerships, with the all-female leadership emphasizing social impact in affordable housing, potentially inspiring similar innovations in emerging markets. Read More

Investment and Fund Reports

Oman Investment Authority (Oman, Sovereign Fund): The Oman Investment Authority (OIA) reported a US $4.1 billion profit for 2024, managing US $53 billion in assets and ranking among the top 10 sovereign wealth funds, with significant investments in AI, healthcare, fintech, and energy transition through its Future Generations Fund, enhancing Oman's position in emerging tech sectors. OIA also launched the US $5.2 billion Future Fund Oman in 2024 to attract foreign investors and scale local startups, committing US $865 million to projects like the Sohar PolySilicon plant and joint funds targeting ICT, renewables, EV supply chains, and agritech, aligning with Oman Vision 2040 and supporting innovation in emerging markets. Read More

Saudi Arabia VC Deployment (Saudi Arabia, VC Market): In the first half of 2025, Saudi Arabia's venture capital deployment reached $860 million, marking a 116% increase compared to the first half of 2024 and surpassing the total VC funding for all of 2024, reinforcing its position as the leading VC market in the MENA region with 56% of the region's capital deployed. The Kingdom also saw a record 114 VC deals, a 31% rise from the previous year, with e-commerce and fintech sectors being particularly prominent, aligning with efforts to foster entrepreneurship under Saudi Vision 2030. Read More

MENA Startup Investment (MENA Region, Overall Funding): In the first half of 2025, MENA startup investments reached $2.1 billion, a 134% increase from 2024, driven significantly by debt-based financing and reflecting strong investor interest despite regional uncertainties, with Saudi Arabia capturing 64% of the total, largely in fintech. The growth highlights the region's appeal to both domestic and international investors, with notable activity in mid-stage and early-stage startups, particularly in B2B models, amidst challenges like currency volatility and macroeconomic strains. Read More

Tech Initiatives and Trials

Saudi Self-Driving Vehicle Trials (Saudi Arabia, Autonomous Tech): Saudi Arabia has initiated a 12-month pilot phase for autonomous vehicles in Riyadh, involving major public areas and supported by government bodies and tech partners like Uber and China-based WeRide, aligning with Vision 2030 to develop a smart transport ecosystem. This pilot, marking the first officially licensed Robotaxi service in the country, aims to transition to full commercial operations by the end of 2025, enhancing AI-powered transport solutions and public-private innovation in the region. Read More

🌍 Global Tech & VC Pulse

The week of July 21, 2025, marked a watershed moment as state-led industrial policy became the primary driver of the global technology landscape. The U.S. "AI Action Plan" sent a shockwave through the market, forcing a strategic recalculation for investors and corporations worldwide.

Deconstructing the "AI Action Plan"

Pillar 1: The "Woke AI" Mandate

Leverages federal purchasing power to enforce ideological alignment. Agencies are restricted from procuring LLMs that don't comply with "Truth-Seeking" and "Ideological Neutrality" principles, explicitly targeting concepts like DEI and critical race theory.

Market Impact: Creates a potent incentive for tech giants to self-censor commercial products or build costly, separate government models, potentially favoring firms like xAI that align with the administration's worldview.

Pillar 2: Data Center Supremacy

Dramatically accelerates the construction of AI data centers by streamlining environmental regulations (NEPA, Clean Water Act) and even allowing companies to build their own power plants to meet energy needs.

Market Impact: Acts as a massive indirect subsidy for the capital expenditure "supercycle" of companies like Microsoft and Meta, but puts the U.S. on a collision course with climate goals and local community interests.

Pillar 3: Exporting the "American AI Stack"

Directs the Dept. of Commerce to support the export of "full-stack AI packages" (hardware, models, software) to allied nations, using federal financing to create a U.S.-centric global tech bloc.

Market Impact: Uses technology as a primary tool of foreign policy to counter China's influence, accelerating the bifurcation of global tech standards and forcing nations to choose a sphere of influence.

Venture Capital: A Tale of Two Markets

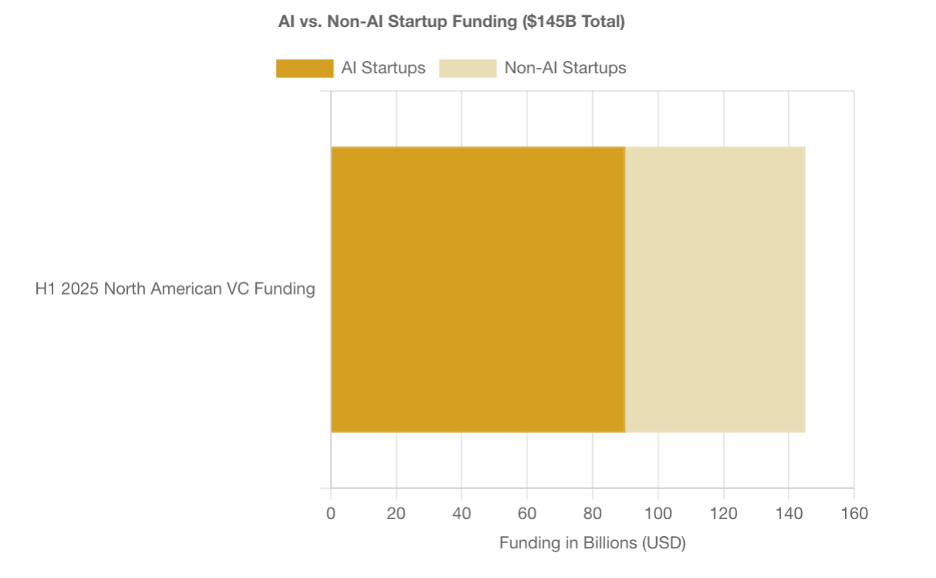

The venture market is defined by a hyper-concentrated boom in AI that masks underlying fragility. While North American VC funding surged 43% YoY in H1 2025 to $145B, nearly $90B of that was directed at AI startups. This chart illustrates the profound disparity in capital allocation, a trend that continued from Q1 where OpenAI's $40B round accounted for over a third of global funding.

M&A Spotlight

The M&A market is dominated by the strategic pursuit of AI capabilities and portfolio optimization. This week's key deals reflect a focus on acquiring vertical AI, consolidating markets, and shedding non-core assets.

Waystar acquires Iodine Software

Driver: Acquiring specialized HealthTech AI to enhance its core payments platform.

DCP Capital acquires Sun Art Retail Group

Driver: Alibaba divests its majority stake for $1.58B to focus on core e-commerce and tech.

ARCHIMED acquires ZimVie

Driver: A publicly-traded MedTech company is taken private by a healthcare-focused investment firm.

Global Dynamics: Divergent Paths, Shared Pressures

The rise of state-led industrial policy and the intense focus on AI are manifesting in distinct ways across key international markets. While all regions grapple with shared pressures, their responses highlight a rapidly fragmenting global landscape. Select a region to explore its unique challenges and strategic maneuvers.

Europe: Caught in a Geopolitical and Economic Vise

The European tech sector is navigating significant turbulence, caught between its ambitions for "strategic autonomy" and the harsh realities of global market forces. The continent's strategy for semiconductor sovereignty faced a major setback with Intel canceling planned fabs in Germany and Poland. This internal churn is happening while Europe is being squeezed by U.S. tech policy and escalating trade disputes, creating a highly unstable operating environment.

Semiconductor Setback: Intel cancels major fab investments, a blow to EUs onshoring efforts.

Trade Friction: The EU is preparing massive retaliatory tariffs in response to U.S. threats, while the U.S. assails the EUs Digital Services Act.

VC Pressure: Startup funding in the key hub of Paris dropped by a third in H1 2025, and the prestigious NATO Innovation Fund is struggling with talent retention.

Pockets of Excellence: Despite challenges, Swedens Lovable became the fastest software company to $100M ARR, and Frances Stellaria raised €23M for its nuclear reactor tech.

Asia: China's Controlled Burn and Regional Maneuvering

The technology landscape in Asia is largely shaped by China's dual strategy: imposing stability on its domestic market while projecting its technological power globally. This "managed decoupling" is a direct response to U.S. policy, aiming to reduce reliance on Western tech while competing to set global standards.

Domestic Control: Beijing is reining in its platform economy, summoning food delivery giants to end price wars and drafting laws to govern algorithmic pricing.

Global Projection: China is hosting the World AI Conference to showcase its progress and promote its own vision for AI governance, symbolized by advanced humanoid robots like UBTech's Walker S2.

Geopolitical Tensions: Taiwan conducted live-fire military exercises with U.S.-made HIMARS, simulating defense against an invasion, as China continues intimidation tactics.

Regional Moves: Vietnam launched a national blockchain platform, and Japan faces political uncertainty ahead of a critical U.S. trade deal deadline.

🎙️Episodes Recap:

In this episode, host Mehmet Gonullu welcomes back Dev Aditya , Co-Founder of OIAI by Otermans Institute, who returns nearly two years after his first appearance to share an extraordinary update: they’ve built an AI teacher that runs completely offline — even on a 2020 Android phone.

From educating learners in refugee camps to scaling across 17 countries, Dev’s mission is clear: make AI-powered learning accessible to the 750 million people underserved by the internet and modern hardware.

In this episode of The CTO Show with Mehmet, host Mehmet Gonullu sits down with Karan Jain , Founder and CEO of NayaOne, to explore the broken state of enterprise tech adoption — and what it takes to fix it.

With over two decades of experience in financial services and technology, Karan is on a mission to eliminate the painful 12-month vendor procurement cycles that cripple innovation in large institutions. NayaOne offers a powerful, secure platform that connects enterprises with technology vendors and enables real-time evaluation using synthetic data, workflow tooling, and curated testbeds.

Let’s Stay Connected

💡 New: Join the Community I’m Building

I’m launching a new founder–operator–investor community focused on B2B tech, deeptech, and cross-border growth between emerging markets and global hubs.

📚 We’ll share GTM learnings, insights from deals, and trends from MEA to the US.

🎤 Events, best practices, and opportunities to learn from each other.

🌍 If you’re a builder or backer who wants to stay ahead of the curve, this is for you.

Thanks for reading — and for being part of this growing, global-minded network.

— Mehmet