Welcome to the 130th edition of The CTO Show Brief!

MEA region is pulsing with startup energy: AI-native platforms, foodtech IPO plays, and sports-tech innovations are drawing serious capital and scaling fast. Meanwhile, on the global stage, the IPO window is wide open, M&A is going full-stack, and national AI strategies are redrawing the map of tech geopolitics. In this issue, we spotlight regional wins like Calo’s $64M raise and OmniOps’ sovereign AI platform — while zooming out to examine how U.S., China, and Europe are using policy and capital to define the next frontier of innovation. Plus, scroll down for two powerful podcast episodes exploring the future of recruiting and the tech of human belonging.

Whether you’re one of our 2,690 subscribers or a first-time reader—grab your coffee, and let’s dive into what’s shaping tech and venture this week!

MEA Tech Momentum

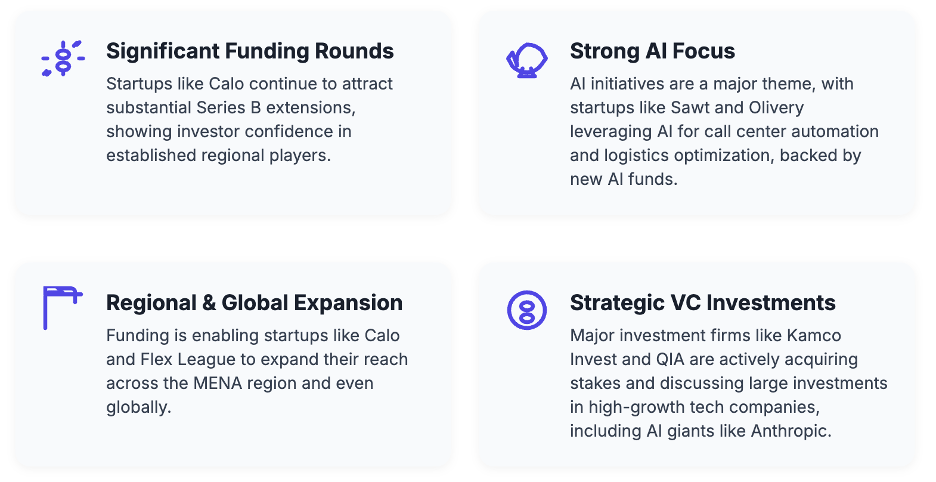

The Middle East & North Africa (MENA) and African startup ecosystems continue to show vibrant activity, with significant investments fueling growth across various sectors. This update highlights key funding rounds, strategic investments by venture capital firms, innovative product launches, and impactful events that are collectively shaping the future of technology and entrepreneurship in these dynamic regions.

Startup Funding News

Calo Raises $39 Million Series B Extension Calo, a Riyadh-based meal subscription startup, raised $39 million in a Series B extension round led by AlJazira Capital, bringing its total Series B funding to $64 million. This investment will support Calo's AI initiatives and global expansion, particularly following its acquisition of two UK-based meal subscription brands. Read More

Olivery Secures Seed Investment Olivery, a B2B SaaS startup based in Ramallah and Amman, has secured an undisclosed seed investment from Ibtikar Fund and Flat6Labs Mashreq Seed Fund to expand its logistics SaaS platform across the MENA region. The funding will support the development of AI-powered features and improve onboarding operations. Read More

Sawt Raises $1 Million Pre-Seed Sawt, a Riyadh-based AI startup, raised $1 million in pre-seed funding led by T2 and STV to automate call centers using Arabic AI agents, marking STV’s first investment from its new AI fund backed by Google. The funding will support the development of Arabic-native voice AI models and expand customer service capabilities across the region. Read More

Flex League Closes Six-Figure Seed Round Flex League, a Saudi sports-tech platform, has closed a six-figure USD seed round led by The Professional Tennis Academy and PAD-L Group, aiming to enhance its court booking system and expand in Saudi Arabia and the MENA region. The funding will also support team growth in engineering, product, and operations to further develop its platform for competitive padel and tennis. Read More

Mataa Closes Seed Round Mataa, a Libya-based e-commerce platform founded in 2022 by Ibrahim Shuwehdi, has closed its first seed investment round with backing from local Libyan business angels. The funding will enhance operational capabilities, including logistics, warehouse expansion, and onboarding more suppliers and product categories, to support growth in Libya and the broader North African region. Read More

VC and Investment Firm Updates

HAVAÍC Secures $25 Million for African Innovation Fund HAVAÍC, a Cape Town-based venture capital firm, has secured $25 million in the second close of its $50 million African Innovation Fund 3 to support scaling Africa-born startups with global ambitions. The funding round was led by Sanlam Multi-Manager, with additional investments from Fireball Capital and the SA SME Fund, aiming to back 15 early-stage, post-revenue startups with high growth potential. Read More

Kamco Invest Acquires Stake in Foodics Kamco Invest, a Kuwait-based financial powerhouse, acquired an undisclosed stake in Foodics, a Saudi Arabia-based foodtech company founded in 2014, as part of its strategy to invest in high-growth tech businesses in the MENA region targeting local IPOs. This investment, closed in Q4 2024, follows Foodics’ $170 million Series C round in 2022 and supports the company’s expected public listing on Tadawul within 2–3 years. Read More

QIA and MGX in Talks to Invest in Anthropic The Qatar Investment Authority (QIA) and UAE’s MGX are in advanced talks to invest in AI startup Anthropic, which is seeking to raise $3-5 billion at a $170 billion valuation. This funding round also involves Singapore’s GIC, lead investor Iconiq Capital, and existing investor Amazon, as Anthropic aims to compete with rivals like OpenAI. Read More

Product Launches

OmniOps Launches Bunyan Platform OmniOps, a leading AI Infrastructure Technology provider in Saudi Arabia, has launched Bunyan, the Kingdom's first sovereign Inference as a Service platform, following a strategic meeting with the Minister of Communications & Information Technology. This platform offers advanced AI capabilities for text, vision, and speech applications, ensuring data sovereignty and compliance while supporting the Saudi National Strategy for Data and AI across various sectors. Read More

Events and Competitions

Pegasus Tech Ventures Organizes Startup World Cup in Turkey Pegasus Tech Ventures, originating from Silicon Valley, organized the Startup World Cup in Turkey, managed by Synergia with support from Bulls GSYO, Bulls Yatırım, Bulls Portföy, and strategic partnerships with BTM, where BLOOCELL won as Turkey’s champion in biotechnology for artificial tissue production and will compete in the world final in San Francisco for a $1 million investment. The event highlighted the shift in entrepreneurship towards ideas and creativity, emphasizing the importance of international connections for Turkey’s startup ecosystem to foster innovation and opportunity equality. Read More

🌍 Global Tech & VC Pulse

The week of 28 July – 3 Aug 2025 was a watershed moment for technology and venture capital. Rapid policy shifts, blockbuster IPOs, record‑breaking corporate valuations and a torrent of capital into AI infrastructure illustrated the new geopolitical operating system for technology. On the ground, venture investors shifted toward larger and more mature deals, while national strategies in the United States, China and Europe began to materially reshape corporate behaviour. The following newsletter synthesises key developments from both reports and highlights the data and policy changes driving technology’s next chapter.

Geopolitics & Policy

U.S. AI Action Plan: deregulation and export push

The Trump administration’s AI Action Plan (released 23 July 2025) seeks to cement U.S. leadership by promoting deregulation, accelerating data‑centre construction and exporting American AI stacks. A draft seen by Reuters indicates the plan will:

· Bar federal AI funding for states with restrictive AI laws and ask the FCC to review conflicting state rules .

· Promote open‑source and open‑weight AI development and export American technologies via full‑stack deployment packages .

· Empower American workers through AI‑enabled job creation while streamlining data‑centre permitting .

This marks a dramatic shift from previous administrations and signals an intent to relax domestic constraints while aggressively exporting U.S. technology. It also underscores the increasing role of national policy in shaping private capital flows; the plan directly ties federal investment to states’ regulatory stances and encourages the build‑out of AI infrastructure.

China’s Model‑Chip Alliance and Self‑Reliance

At the World Artificial Intelligence Conference in Shanghai, Chinese tech firms announced two alliances to build a domestic AI ecosystem. The Model‑Chip Ecosystem Innovation Alliance links large‑language‑model developers with AI chip manufacturers such as Huawei, Biren and Enflame . By connecting chips, models and infrastructure, the alliance aims to reduce dependence on foreign technology . A second alliance, under the Shanghai General Chamber of Commerce, focuses on integrating AI into industrial transformation . These moves illustrate Beijing’s multi‑pronged strategy: fostering open‑source collaboration, building indigenous hardware and proposing global AI governance bodies as a counterweight to U.S. dominance.

Europe’s innovation gap and new funding engines

Europe continues to confront a serious innovation deficit. Mario Draghi’s Report on European Competitiveness concludes that only four of the world’s top‑50 technology companies are European and recommends boosting investment by €750–800 billion per year . The report calls for joint EU borrowing and the creation of an agency modelled on DARPA , noting that Europe must close its innovation gap with the U.S. and China. In parallel, European venture firms are raising larger growth funds: for example, Berlin‑based Project A closed an oversubscribed €325 million Fund V in June 2025, signalling growing dry‑powder on the continent .

Regulatory enforcement

While governments articulate grand strategies, enforcement is picking up. The European Commission began applying the Digital Services Act (DSA) by issuing preliminary findings that the Chinese e‑commerce platform Temu breached rules for illegal products, demonstrating that regulatory pronouncements are translating into real-world penalties. In the United States, the AI Action Plan will accelerate export controls and data‑centre permitting, adding new compliance pressures for international technology firms.

Capital Markets & Corporate Activity

IPO window reopens

The week saw a stunning return of risk appetite in public markets. Design software firm Figma priced its IPO at $33 per share and opened for trading at $85, a jump of around 200% that valued the company at about $50 billion . This debut, far above the $20 billion price tag Adobe once offered, signals that high‑growth tech companies can command premium valuations in the public markets. On the space‑technology front, Firefly Aerospace filed to raise up to $631.8 million by selling 16.2 million shares at $35–$39 each, targeting a valuation of about $5.5 billion . The strong investor interest in Firefly underscores a broader trend: defence and space companies aligned with national priorities are attracting enthusiastic capital.

M&A: Full‑stack consolidation

Major deals illustrate the shift from point solutions to vertically integrated platforms:

· Palo Alto Networks → CyberArk ($25B) – Palo Alto agreed to buy identity‑security specialist CyberArk for about $25 billion, seeking to build a unified cybersecurity platform that spans human, machine and AI identities . Analysts see the transaction as a response to rising AI‑driven threats and the need for comprehensive security solutions.

· CoreWeave → Core Scientific ($9B) – AI cloud provider CoreWeave is acquiring data‑centre operator Core Scientific to secure physical infrastructure for the AI boom.

· STMicroelectronics → NXP’s MEMS business ($950M) – ST’s acquisition of NXP’s automotive‑focused MEMS business rebalances its portfolio toward high‑growth, high‑margin sensors for advanced driver‑assistance systems.

These transactions highlight an AI infrastructure land‑grab: owning the full stack—from chips and servers to networking and security—creates durable moats in the AI era.

Venture Capital Dynamics

Venture capital flows demonstrate a flight to quality and geographic specialisation. Investors concentrated on later‑stage rounds for companies with demonstrated traction. Israel remained a standout, with cybersecurity startups such as Noma Security raising $100 million to secure AI models . Europe’s funding ecosystem matured as more growth‑stage funds closed, reducing the historical “Series B gap” and enabling local startups to scale without depending on U.S. capital.

Biotech & frontier tech

Biotech firms continued to secure massive rounds for technically complex projects. Although not covered in detail here, MapLight Therapeutics’ $372 million Series D and Artbio’s $132 million financing highlight investor appetite for long‑duration, high‑impact science. These deals are often co‑led by crossover investors and strategic pharma partners, reinforcing the symbiotic relationship between Big Pharma and venture‑backed biotech.

Crypto & fintech

Crypto projects raised $322 million across 26 deals, while fintech funding exceeded $2 billion during the week, driven by cross‑border payments and alternative investment platforms. Although these sectors lacked the headline‑grabbing mega‑rounds seen in AI, they illustrate ongoing diversification in venture portfolios.

🎙️Episodes Recap:

In this special 500th episode of The CTO Show with Mehmet, we dive deep into the talent game behind startup scaling and private equity moves. Joining us is Justin Dixon, MBA , founder of Hire Tomorrow, who brings nearly two decades of recruiting experience—from Fortune 500s to early-stage startups and PE-backed ventures.

In this episode of The CTO Show with Mehmet, we sit down with Glen Cameron , founder and CEO of Bonded, to explore how technology can validate the most human thing we have: relationships.

From immigration barriers to identity verification in a deepfake world, Glen unpacks the inspiration behind Bonded.

Let’s Stay Connected

💡 New: Join the Community I’m Building

I’m launching a new founder–operator–investor community focused on B2B tech, deeptech, and cross-border growth between emerging markets and global hubs.

📚 We’ll share GTM learnings, insights from deals, and trends from MEA to the US.

🎤 Events, best practices, and opportunities to learn from each other.

🌍 If you’re a builder or backer who wants to stay ahead of the curve, this is for you.

Thanks for reading — and for being part of this growing, global-minded network.

— Mehmet