Welcome to Issue 132 of The CTO Show Brief!

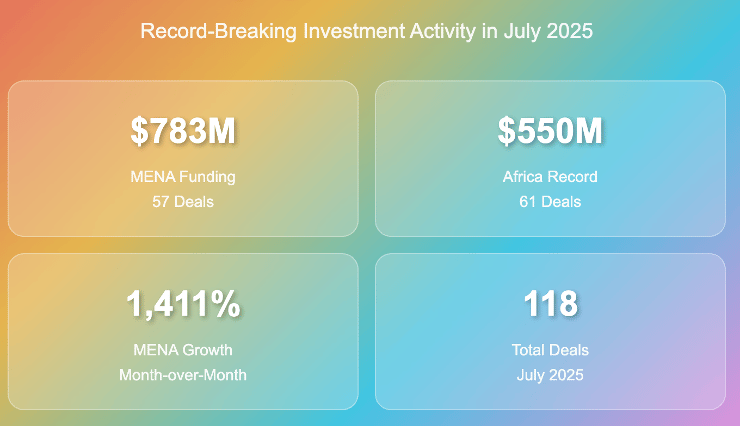

July 2025 was a landmark month for emerging market tech. MENA startups surged to $783M across 57 deals—a staggering 1,411% jump from June—while African startups broke records with $550M raised across 61 deals. From Breadfast’s $10M round in Egypt to Altera Biosciences’ breakthrough funding in South Africa and Ultraviolette’s $21M in India, momentum is building across fintech, gaming, AI, and sustainability. Strategic moves like Revolut’s entry into Morocco and Abhi’s Saudi launch further underscore a region in transformation, fueled by economic diversification, global capital, and bold technological bets.

Whether you’re one of our 2,694 subscribers or a first-time reader—grab your coffee, and let’s dive into what’s shaping tech and venture this week!

🚀 Working on something exciting for founders & investors

Over the past months, I’ve been quietly building a new way to back bold founders in B2B tech and DeepTech scaling between MENA and the US. If you’re an investor or ecosystem builder who wants to explore how we can create impact together, let’s connect.

MEA Tech Momentum

The Middle East, Africa, and other emerging markets are witnessing a robust surge in tech and startup investments in July 2025, with MENA startups raising $783 million across 57 deals and African startups securing a record $550 million across 61 deals, driven by sectors like fintech, gaming, AI, and sustainability. Key developments include significant funding rounds for companies like Egypt’s Breadfast ($10M), South Africa’s Altera Biosciences (R29M), and India’s Ultraviolette ($21M), alongside strategic expansions by firms like Revolut in Morocco and Abhi in Saudi Arabia, reflecting a dynamic ecosystem fueled by economic diversification and technological innovation.

Funding Reports

MENA Startup Funding Surge: MENA startups raised $783 million in July 2025 across 57 deals, a 1,411% increase from the prior month, led by Saudi Arabia and the UAE with significant investments in deeptech and e-commerce. Read More

Turkey’s Investment Landscape: In the first half of 2025, Turkey's startup ecosystem attracted $211 million across 91 deals, with fintech leading at $97.1 million, followed by gaming at $72.4 million and AI at $12.6 million, driven by the country's young, tech-savvy population. Read More

Middle East Private Equity Growth: The Middle East private equity market is projected to grow from $19.7 billion in 2024 to $35.5 billion by 2033 at a 6.75% CAGR, fueled by economic diversification, technology focus, and ESG investments in sectors like healthcare and renewables. Read More

African Startup Funding Record: African startups raised a record $550 million in July 2025 across 61 deals, dominated by debt financing and led by Kenyan energy firms, with Morocco emerging as a key player beyond the traditional Big Four markets. Read More

MENA Startup Funding

Breadfast’s Series B2: Egyptian grocery delivery startup Breadfast secured $10 million from EBRD in its Series B2 round led by Novastar Ventures, nearing a $400 million valuation to expand operations and its fintech arm across Egypt. Read More

Impact46 Gaming Investments: Saudi VC Impact46 invested $6.6 million across five gaming studios via its $40 million Gaming Fund, focusing on mobile, PC, and culturally localized games to bolster the region's creative sector. Read More

Hypeo Ai’s AI Influencer Platform: Moroccan AI startup Hypeo Ai raised funding from Renew Capital to advance its platform connecting brands with creators, including AI-generated "Meta Humans," and launch a wellness coaching product. Read More

MENA Expansions and Milestones

Revolut Enters Morocco: European fintech Revolut is entering Morocco led by former Uber executive Amine Berrada, competing against local giant Cash Plus, which is investing €57 million in digital transformation. Read More

Abhi’s Saudi Launch: Pakistani fintech Abhi launched its earned wage access platform in Saudi Arabia via a $200 million partnership with Alraedah, integrating with local systems to offer instant wage access without subscription fees. Read More

Sira’s Community Milestone: Jordan-based professional community Sira celebrated three years with 150+ members across Jordan and UAE, generating $4.2 million in collective wealth through collaborations and jobs. Read More

African VC Funds and Investments

REdimension Capital Fund: South African VC REdimension Capital closed a R250 million fund for proptech and sustainability startups, backed by investors like Hyprop and Growthpoint to drive innovation in the built environment. Read More

TLcom’s TAPSI Fund: TLcom Capital’s $5 million TAPSI pre-seed fund has deployed half its capital into African startups, including a recent $2 million investment in South African travel fintech TurnStay. Read More

Enza Capital’s North Africa Focus: Pan-African VC Enza Capital has tripled its North African investments in two years, focusing on fintech, logistics, and healthcare amid rising funding in Egypt and the region's ties to Europe and the Middle East. Read More

African Startup Funding

Altera Biosciences’ Landmark Round: Cape Town-based Altera Biosciences, Africa's first cell and gene therapy startup, raised R29 million in pre-seed funding from OneBio and E Squared to develop universal donor cells for treatments like diabetes and cancer. Read More

HoneyCoin’s Stablecoin Expansion: Kenyan fintech HoneyCoin raised $4.9 million from Visa Ventures and others to expand its stablecoin-powered payments platform, processing $150 million monthly across 45+ countries. Read More

Ampersand’s Electric Mobility: East African electric motorbike firm Ampersand secured funding from BII and others to double its battery fleet by 2026, expanding swaps and charging infrastructure for sustainable transport. Read More

Chowdeck’s Series A: Nigerian food delivery startup Chowdeck raised $9 million in Series A from Novastar and Y Combinator to expand in Nigeria and Ghana, opening dark stores for quick commerce in food and groceries. Read More

TurnStay’s Travel Fintech: South African travel fintech TurnStay raised $2 million from TLcom Capital and others to accelerate its expansion across Africa, offering seamless payment solutions for travelers. Read More

Street Wallet’s Funding: South African fintech Street Wallet secured funding to expand its digital wallet services, aiming to enhance financial inclusion across the region. Read More

Other Emerging Markets

Ultraviolette’s EV Funding: Indian electric motorcycle maker Ultraviolette raised $21 million led by TDK Ventures to scale manufacturing, R&D, and global expansion following its new scooter launch. Read More

🌍 Global Tech & VC Pulse

The global technology market is undergoing a structural realignment, driven by the immense gravity of artificial intelligence. This week's events highlight a bifurcated venture capital landscape, a fragile public market, and an intense, capital-heavy arms race for AI dominance among tech behemoths. This dashboard provides an interactive exploration of these key trends.

The Venture Capital Landscape

While headline funding numbers suggest a market recovery, the reality is a tale of two markets. Capital is heavily concentrated in a few late-stage AI giants, while early-stage and non-AI startups face a persistent "VC winter." This section visualizes this bifurcation and allows you to explore the week's most significant funding rounds.

Strategic Maneuvers of Tech Behemoths

OpenAI GPT-5's Bumpy Rollout & Open-Source Pivot

OpenAI launched its anticipated GPT-5 model, but faced user backlash over perceived performance issues, highlighting the challenge of upgrading a product for 700 million weekly users. Concurrently, in a major strategic shift, OpenAI released its first open-weight models since 2019, a defensive move to compete with the burgeoning open-source AI movement led by Meta and Mistral.

Google: Multi-Pronged AI Offensive

Google expanded its AI ecosystem by partnering with Oracle to offer Gemini models to cloud customers, directly challenging the Azure-OpenAI partnership. For developers, it launched "Jules," an AI coding agent. On the consumer front, it's promoting the upcoming Pixel 10, expected to feature advanced on-device AI capabilities like "Conversational Photo Editing."

META: The $29 Billion Infrastructure Imperative

In a landmark deal, Meta secured a $29 billion financing package to fund a massive expansion of its AI data center infrastructure. The capital will bankroll a new "multi-gigawatt" AI supercomputing complex, signaling that access to vast capital for infrastructure is now a critical competitive moat in the AI arms race, solidifying the dominance of a few well-capitalized players.

Global Hotspots

The global tech landscape is a mosaic of distinct regional dynamics. North America's talent market is decentralizing, India's startup scene is booming, and Mexico has surprisingly surpassed Brazil as Latin America's top destination for venture capital for the first time in a decade.

North America: Decentralizing Talent

While Silicon Valley remains a key hub, its largest tech employers are growing their headcount much faster globally (59%) and nationally (44%) than locally (20%), confirming the impact of remote work.

Asia: India's Boom vs. China's Tech War

India is experiencing a vibrant startup boom with major funding rounds and upcoming IPOs. China's tech scene is defined by its response to US sanctions, pursuing self-sufficiency and state-backed investment.

Europe: Niche Strengths, Macro Headwinds

Europe shows strength in specialized B2B sectors, but larger players like Klarna face profitability challenges, highlighting persistent headwinds for the continent's tech giants.

Liquidity Horizons: IPO & M&A

A healthy exit environment is critical. This week offered encouraging signs with a successful IPO and a continued surge in strategic M&A, primarily driven by the corporate race for AI capabilities.

The Public Market Reawakens

Bullish (BLSH) IPO

+83.78% First-Day Gain, $1.11 Billion Raised

The successful debut of Peter Thiel-backed crypto exchange Bullish provides a jolt of optimism to the tech IPO market, signaling renewed investor appetite for high-growth tech assets and potentially opening the IPO window for others like Databricks and Discord.

Big Tech's AI Shopping Spree

M&A remains the primary source of liquidity, with disclosed deal value up 155% in H1 2025 vs H1 2024. The driver is the strategic shift from "acqui-hires" to "capability-hires"—acquiring fully-formed teams that have solved specific, complex AI problems.

· Salesforce → Waii: Acquiring natural language database query capability.

· Doximity → Pathway AI: Acquiring a specialized clinical AI team.

· Meta → WaveForms (reported): Acquiring emotional AI voice synthesis capability.

🎙️Episodes Recap:

In this episode of The CTO Show with Mehmet, I sit down with Lars Maaløe , Co-Founder and CTO of Corti.ai, to explore how AI is transforming healthcare. From explainability and compliance to building scalable AI infrastructure, Lars shares his journey from researching generative models to delivering life-changing technology for clinicians and patients worldwide.

What if our education system is training students for jobs that no longer exist? In this eye-opening conversation, bestselling author, film producer, and former venture capitalist Ted Dintersmith shares why decades of math education have missed the mark — and what we must teach instead to prepare for the AI-driven future.

In this episode of The CTO Show with Mehmet, I’m joined by Elipaz Tanzman , Co-Founder and CEO of Cygnostic. Elipaz brings a wealth of experience from his early career as a cybersecurity officer in the Navy to leading innovative solutions in application, AI/ML, and cloud security.

🎙 Sponsor This Newsletter & Podcast

Reach founders, tech leaders, and investors across MENA and beyond through this newsletter and The CTO Show with Mehmet. Let's Talk

Thanks for reading — and for being part of this growing, global-minded network.

— Mehmet