Sponsored Content

iACCEL GBI , a Dubai SME–patronaged Go-To-Market Accelerator established in March 2023, has already partnered with leading VCs, the Dubai Chamber of Commerce, the UAE National Incubator, and other key stakeholders to support startups across the region.

Building on this foundation, they are now introducing ELEVIX, a curated digital and growth platform designed to help startups scale smarter by addressing critical gaps identified through work with hundreds of GCC founders.

What ELEVIX offers:

🔗 Connections to vetted service providers and capability partners

📚 Insights, tools, and resources to accelerate growth

🤝 Opportunities for collaboration and visibility in a curated ecosystem

🚀 Be among the first 50 startups to join the inaugural cohort and enjoy exclusive early-access benefits tailored for high-growth ventures.

👉 Reserve Your Spot: Email [email protected]

Welcome to Issue 135 of The CTO Show Brief!

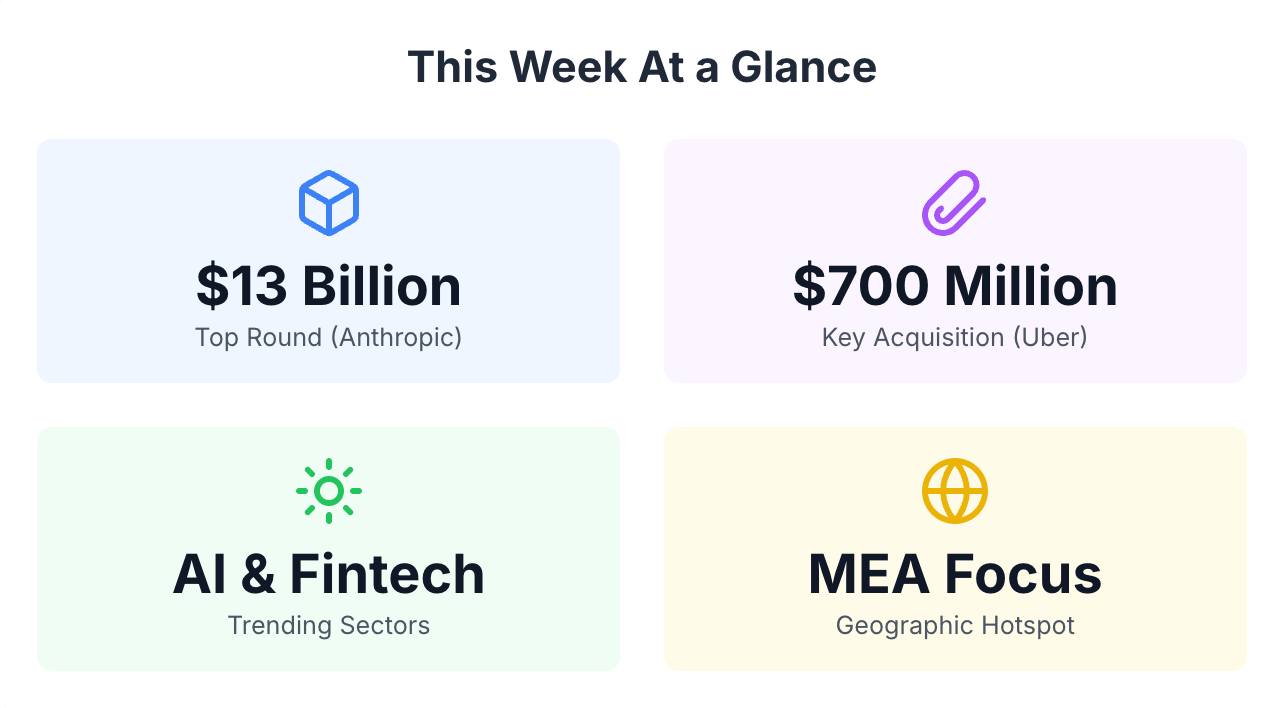

This week in tech and venture capital, momentum is building across both regional and global markets. In MENA, we saw fintech, proptech, autotech, and AI ventures secure fresh rounds of capital, underscoring the region’s growing role as a launchpad for innovation. Ecosystem partnerships—from Tanzania to pan-African VC initiatives—signal a deepening of capital access for early-stage founders. Meanwhile, globally, the IPO window is finally reopening after months of dormancy, AI continues its shift from copilots to fully autonomous workflows, and consolidation in AI security highlights the race to secure the enterprise perimeter. Together, these trends point to an inflection moment: capital is flowing again, infrastructure is modernizing, and startups that can execute with speed and trust are best positioned to ride this next wave.

Whether you’re one of our 2,719 subscribers or a first-time reader—grab your coffee, and let’s dive into what’s shaping tech and venture this week!

📖 Special Announcement:

From Nowhere to Next

🚀 The wait is over! I’m excited to share that my book, From Nowhere to Next, is officially launching on September 10th 🎉

This book is a collection of lessons, stories, and insights shaped by my journey — and by the incredible voices I’ve hosted on The CTO Show with Mehmet. At its core, From Nowhere to Next is about transformation, building momentum, and finding your path — whether you’re a founder, operator, or someone navigating your next big move.

👉 To celebrate, we’ll be hosting a live launch webinar on September 10th:

📅 9am PT | 12pm ET | 8pm GST

MEA Tech Momentum

Funding Rounds

· Munify (Egypt): Munify, an Egyptian fintech startup founded in 2024, raised $3 million in seed funding led by Y Combinator to develop a cross-border neobank for the Egyptian diaspora and freelancers, offering U.S. banking access with local IDs. The platform supports remittances and multi-currency accounts in USD, EUR, and GBP, with thousands of sign-ups already

· Seraya (UAE): Seraya, a UAE proptech startup, secured $1.8 million in a seed round combining equity and debt, led by a KSA family office and DLL, to expand its premium serviced apartment portfolio in Dubai to 50 units by 2025. The funding, bringing total capital to $2.15 million, targets the growing short-term rental market in the region.

· WheelsOn (UAE): WheelsOn, a UAE autotech startup, raised $12.5 million to modernize car rentals with a deposit-free, AI-driven digital platform featuring dynamic pricing and digital car keys. The funds, including equity from MENA investors and bank financing, will support fleet expansion and potential Gulf region growth.

· Intella (Saudi Arabia/Egypt): Intella, an AI startup headquartered in Saudi Arabia and founded in Egypt, raised $12.5 million in an oversubscribed Series A led by Prosus to enhance AI models for Arabic dialects and expand in the MENA region. The funds will drive R&D, product development, and hiring, focusing on transcription and analytics for over 25 Arabic dialects.

· Anthropic (Global with Qatar Involvement): Qatar Investment Authority joined Anthropic’s $13 billion Series F round, led by Iconiq Capital, valuing the AI firm at $183 billion, reflecting strong global interest in AI innovation. The round, supported by Fidelity, Lightspeed, and others, excludes UAE’s MGX but underscores MEA’s growing role in AI investments.

· Justyol (Morocco): Justyol, a Moroccan e-commerce platform founded in 2022, raised $1 million, including $400,000 in equity and $600,000 in inventory financing, to scale operations in Morocco and the MENA region. The funding will enhance operational capacity and prepare the company for a future Series A round.

· Addvocate.AI (Tunisia): Tunisia’s Addvocate.AI, founded in 2024, received investment from 216 Capital to develop its AI-driven “Sales Performance OS,” optimizing sales pipelines by acting as a digital copilot for data consolidation and meeting preparation. The funding will accelerate innovation and support international expansion, addressing global sales inefficiencies.

· Intella (Egypt): Egypt-based Intella secured $12.5 million in a Series A round led by Prosus, totaling $16.9 million, to scale its dialectal Arabic speech intelligence solutions across MENA, enhancing R&D and launching Ziila, an Arabic digital human for voice-ordering with Jumia. The company’s AI models, achieving 95.73% speech-to-text accuracy, serve sectors like finance and telecommunications.

· KITEAI (Emerging Markets Focus): KITEAI, a blockchain-AI startup, raised $18 million in Series A funding led by PayPal Ventures and General Catalyst to build infrastructure for the “Agentic Internet,” integrating AI agents with stablecoin payments in emerging markets. The round, totaling $33 million with investors like Samsung Next, supports expansion with Shopify and PayPal merchants.

· Basata Holding (Egypt): Basata Holding, an Egyptian e-payment company, plans to invest $7 million in 2026 to strengthen its market position in Egypt and expand regionally, including into Saudi Arabia and Morocco. The investment will support acquisitions and new services, pending regulatory approvals, through collaborations with sister companies.

· Etherealize (Global with Emerging Implications): Etherealize, launched in 2025, raised $40 million led by Electric Capital to tokenize traditional assets like mortgages on Ethereum, targeting Wall Street institutions. The funding will drive adoption in emerging markets by modernizing financial infrastructure for banks and asset managers.

· Aria (Emerging Markets Focus): Aria raised $15 million to expand on-chain IP markets, launching $APL, a token for music IP rights by artists like BLACKPINK, and plans to grow into art and cultural IP in emerging markets. The funds will accelerate protocol development and rights holder onboarding for a programmable IP ecosystem.

Partnerships

· Tanzania Startup Association & Africapital (Tanzania): The Tanzania Startup Association partnered with Africapital for three years to provide alternative financing like revenue-based loans and convertible debt, addressing the funding gap for Tanzanian tech startups. This collaboration aims to boost East Africa’s tech ecosystem by improving capital access for early-stage ventures.

· Uncovered Fund & Monex Ventures (Africa/MEA): Japan’s Uncovered Fund and Monex Ventures launched a $20 million fund, UMAIP, to invest $100,000 to $2 million in early-stage African and MEA startups in sectors like fintech and agritech. The partnership reflects growing Japanese VC interest in Africa’s startup ecosystem, targeting mobility and climate tech ventures.

Acquisitions

· Solowin & AlloyX (Emerging Markets Focus): Solowin Holdings acquired AlloyX for $350 million in an all-stock deal to enhance its stablecoin ecosystem, targeting emerging markets like Africa and the UAE with enterprise-grade stablecoin applications and asset tokenization. The acquisition aims to blend traditional and decentralized finance for regions with limited banking access.

· Turkey Startup Ecosystem (Turkey): Turkey’s startup ecosystem reached a $857.9 million valuation in Q2 2025, driven by 46 transactions, with Uber’s $700 million acquisition of an 85% stake in Trendyol Go as a key highlight. Foreign investors, accounting for 97% of transaction volume, fueled growth, particularly in early-stage and seed investments.

Ecosystem Reports

· Lagos Startup Ecosystem (Nigeria): Lagos attracted over $6 billion in startup funding over the past five years, with Governor Sanwo-Olu and Minister Tijani promoting its tech ecosystem at GITEX Nigeria 2025 to global investors. The state’s vibrant startup scene highlights Nigeria’s growing role in emerging markets tech.

· African Angel Academy (Africa): The African Angel Academy launched its 12th cohort to address Africa’s $194 billion startup funding gap, having trained 770+ investors and facilitated $53.6 million in deals across 26 countries. Starting September 17, 2025, the cohort offers tracks for new and experienced investors to support high-potential startups in fintech and health tech.

🌍 Global Tech & VC Pulse

This week signals a pivotal shift in the market as the IPO window reopens, reviving late-stage confidence. In the AI domain, the focus is rapidly moving from copilots to fully autonomous, agentic workflows—a trend validated by major enterprise product launches and significant VC funding. This is forcing consolidation in AI security and prompting platform players like OpenAI to vertically integrate by acquiring tooling and building applications.

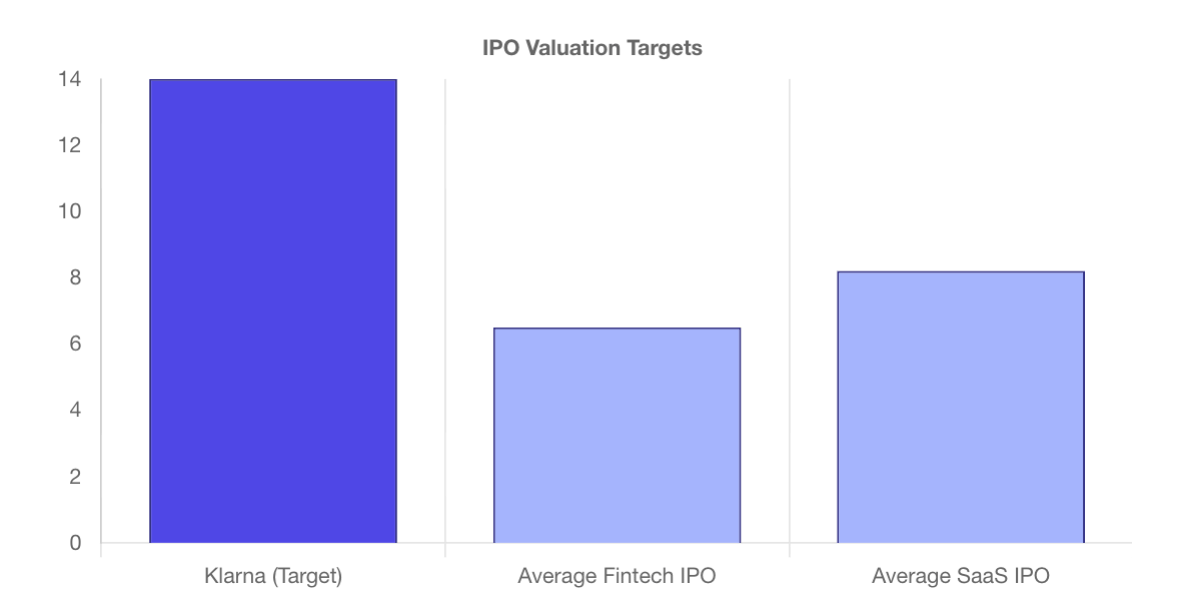

IPO Window Reopens Post–Labor Day

The U.S. IPO calendar sprang back to life with roadshows/pricings for Klarna (targeting a ~$14B valuation), Gemini, Figure, Legence, Via, and Black Rock Coffee—part of a broader pipeline that could reach dozens of listings into year-end.

Impact Analysis

A functioning exit market revives late-stage pricing power and LP confidence. Expect a ripple into growth-stage rounds and secondary liquidity as bankers test demand for profitable (or near-profitable) stories—and increased scrutiny on unit economics for the rest.

OpenAI Keeps Building the “Apps” Layer

OpenAI announced an AI-powered hiring platform (launching 2026) to compete with LinkedIn, and separately acquired Statsig, a feature-flag/experimentation platform, to speed AI product launches.

Impact Analysis

Expect tighter loops between model outputs, user telemetry, and product iteration. For startups, the moat shifts toward proprietary data + experimentation velocity; for HR-tech and dev-tools, brace for platform competition and distribution cross-winds

Agentic AI Hits Mainstream Data Stacks

Databricks unveiled a Data Science Agent (preview) to automate EDA, model training, and troubleshooting; Neo4j launched Infinigraph to merge OLTP/OLAP for real-time, agentic workflows. This trend is supercharged by VC conviction, with autonomous agent startup "Cognition Nexus" raising a $500M Series B.

Impact Analysis

Tooling is moving from “copilots” to autonomous workflows. Teams that wire agents into data/ML pipelines will compress cycle times and headcount needs for routine analytics—reshaping RevOps, FP&A, and fraud stacks first.

AI Security Consolidation Accelerates

Varonis agreed to buy AI-native email security firm SlashNext for up to $150M, integrating multi-channel phishing/QR/BEC defenses; Cato Networks acquired Aim Security to fold “Generative AI security posture” into its SASE stack.

Impact Analysis

The perimeter is now identity + inbox + chat. Consolidation favors platforms that can observe data access and human comms together—good news for full-stack data security players and for CISOs seeking vendor reduction ahead of 2026 renewals.

Funding Pulse: Activity Up, Dollars Mixed

Global weekly data show 86 rounds (+11%) totalling ~$4.1B (-19%) vs. prior week; India posted modest improvement with Tessolve leading; Europe highlighted sizable raises in Netomnia, IQM, CHARM Therapeutics, Phasecraft.

Impact Analysis

Deal count is rebounding while average check sizes normalize. Early-stage is healthier than 2024’s trough, but mega-rounds remain selective—another reason the reopening IPO window (Trend #1) matters for late-stage recycling.

🎙️Episodes Recap:

In this episode of The CTO Show with Mehmet, Derrick Girard shares his remarkable journey from financial services advisor to tech founder — despite having no technical background. Derrick opens up about scaling his company without a traditional sales team, surviving multiple lawsuits, and ultimately selling his business. His story is one of grit, resilience, and what he calls the FIO (Figure It Out) mindset — a framework every founder and leader can adopt to overcome obstacles and drive success.

In this episode of The CTO Show with Mehmet, I sit down with Jon Sabes, Founder & CEO of Longevity FP, serial entrepreneur, and author of Healthy Wealthy Longevity. We explore how the intersection of health, wealth, and technology is reshaping our future. From the basics of extending healthspan to the economic implications of an aging population, Jon shares practical wisdom and groundbreaking insights for entrepreneurs, investors, and anyone interested in living longer — and better.

In this episode of The CTO Show with Mehmet, I sit down with Soha Ashrafian, co-founder of Temis and a fearless serial entrepreneur who turned early challenges into a global track record of business building. From launching her first startup at 21 in Iran—against social resistance and financial restrictions—to building ventures across Dubai, Soha’s journey is a powerful lesson in resilience, creativity, and the true drivers of business success.

🎙 Sponsor This Newsletter & Podcast

Reach founders, tech leaders, and investors across MENA and beyond through this newsletter and The CTO Show with Mehmet. Let's Talk

Thanks for reading — and for being part of this growing, global-minded network.

— Mehmet