Welcome to Issue 139 of The CTO Show Brief!

From Silicon Valley to Riyadh, AI and capital both got real this week.

Globally, mega deals like EA’s $55B take-private, TikTok’s $14B divestment, and Figure AI’s $1B round marked a shift from speculation to strategy — where edge AI, compliance, and sovereign capital are redrawing tech’s map.

Meanwhile across MENA and emerging markets, startups like Aydi, Sabika, YAL.ai, and Tokinvest secured fresh rounds as regional VCs — BECO Capital, Sukna, and Merak — launched new funds powering fintech, AI, and digital infrastructure.

The message from both fronts is clear: innovation is converging with regulation and real value creation — the AI decade is officially in execution mode.

Whether you’re one of our 2,768 subscribers or a first-time reader—grab your coffee, and let’s dive into what’s shaping tech and venture this week!

MEA Tech Momentum

Startup Funding Rounds

Egypt-based Sabika, a Sharia-compliant digital platform for gold and silver investments, has raised a six-figure USD strategic funding from M-Empire Angels to expand its operations and user base in the MEA region. This investment supports the growth of fintech innovations tailored to Islamic finance principles in emerging markets. It highlights increasing VC interest in accessible precious metals investment platforms for retail investors. Egypt's Sabika raises strategic funding from M-Empire Angels

UAE-based agritech platform Aydi has raised $7.5 million in seed funding to launch Orth, an AI-powered agronomy assistant offering personalized real-time insights for growers to optimize crop management and sustainability. The investment, led by COTU Ventures and others, will drive product development and market expansion in the MEA and beyond, underscoring VC support for AI-driven solutions in emerging market agriculture. This initiative aims to empower smallholder farmers with data-driven tools to enhance yields and reduce environmental impact. Aydi raises $7.5 million seed to launch its AI agronomy assistant

Saudi Arabia-based tech startup Sadq, founded in 2022, has secured a $1 million pre-Series A funding extension led by Impact46, following its earlier $1.5 million pre-Series A round led by X by Unifonic Fund. The platform specializes in digital signatures and document authentication compliant with national standards, and the new investment will support accelerated product development, enhanced security, and market expansion across Saudi Arabia and the broader region. This funding underscores growing VC interest in MEA's digital infrastructure and enterprise software sectors, with Impact46 highlighting Sadq's role in building sovereign digital trust solutions for emerging markets. Sadq secures $1 million pre-Series A extension

South Korean AI chip startup Rebellions raised $250 million in a Series C funding round at a $1.4 billion valuation, with investors including Arm, Samsung Ventures, Pegatron VC, Korea Development Bank, Korelya Capital, and Lion X Ventures, building on prior backing from Saudi Arabia's Wa’ed Ventures, Aramco's VC arm, which led a $15 million Series B extension in July 2024 to support entry into the Kingdom's AI infrastructure market. This marks Rebellions' first MENA investor involvement and highlights growing VC activities in emerging markets like Saudi Arabia for AI technologies. The company has established a subsidiary in Riyadh and deployed its first-generation chips in Saudi Arabia, alongside Japan and the US, while planning expansions to support sovereign AI initiatives in key regions. Rebellions closes $250 million Series C, powering AI chip deployment across KSA

India-founded and UAE-based martech startup Climaty AI raised $2 million in early-stage funding led by global venture capital and accelerator fund Turbostart, with participation from AI experts and angel investors, highlighting VC interest in sustainable tech innovations in emerging markets like MEA. Founded in 2024 by Neel Pandya, Climaty AI is developing an Agentic AI-powered marketing ecosystem that automates campaign planning, content creation, optimization, and measurement while reducing the carbon footprint of digital advertising. The funding will support global scaling of its CliMarTech platform, with expansion into APAC, EMEA, the UK, and North America. Turbostart leads $2 million round in Climaty AI

Saudi Arabia-based Tadawulcom Real Estate, a proptech SaaS platform focused on digitizing real estate operations, has secured $400,000 in a Seed funding round led by an angel investor to support its expansion in the Kingdom of Saudi Arabia and the broader regional PropTech market. The funding will enable the rollout of new tech tools, including market analytics and interactive mapping features, to enhance user experience for brokers, companies, and individuals managing listings, contracts, payments, and integrations with government systems. This investment highlights growing VC activity in MEA's emerging proptech sector, aiding Tadawulcom's scaling efforts as a licensed platform regulated by the Real Estate Authority. Tadawulcom closes $400,000 seed to advance proptech services in KSA

Saudi Arabia-based DOO, an AI-powered customer experience platform, has raised $1.7 million in funding led by Merak Capital to enhance AI integration for businesses in the MEA region. The investment will accelerate product development, expand market reach, and improve personalized customer interactions through advanced AI tools. This funding reflects surging VC interest in AI-driven enterprise solutions for emerging markets. DOO lands $1.7 million funding to deepen AI adoption

UAE-based YAL.ai, a quantum-encrypted communication safety startup founded in 2024, has secured $12 million in Series A funding to scale its secure messaging and data protection technologies. The investment will support global expansion and R&D in advanced encryption for enterprises in high-security sectors across MEA and beyond. This round highlights VC enthusiasm for cybersecurity innovations in emerging markets amid rising digital threats. YAL.ai secures $12 million Series A

UAE-based Tokinvest, a regulated marketplace for real-world asset tokenization, has raised $3.2 million in pre-seed funding and secured a multi-asset licence from VARA to expand its RWA investment platform. Building on a prior $500,000 raise, the new capital will enhance platform features, compliance, and market penetration in the MEA crypto and fintech space. This development signals strong VC backing for blockchain innovations in emerging markets' digital asset ecosystems. Tokinvest raises $3.2 million pre-seed, secures VARA multi-asset licence

UAE-based fintech UPFRONT has secured $10 million in pre-seed funding, combining equity and debt, to tackle cash flow challenges for SMEs in the construction sector across MEA. The investment, led by Palm Ventures, will fuel platform enhancements and regional expansion of its invoice financing and payment solutions. This hybrid funding model exemplifies innovative VC approaches in emerging markets to support real economy tech enablers. UPFRONT secures $10 million pre-seed in debt-equity mix

VC Fund Launches/Closings

Kazakhstan has launched the state-backed Alem Crypto Fund, managed by Qazaqstan Venture Group within the Astana International Financial Centre, to build long-term digital asset reserves and support the nation's ambition to become a digital finance hub in Central Asia, an emerging market. The fund's initial investment targets Binance's BNB token through a partnership with Binance Kazakhstan, aligning with broader plans for a $1 billion national crypto reserve to enhance economic stability. This initiative highlights growing VC involvement in blockchain and digital assets in emerging markets, blending state policy with private-sector expertise from global crypto leaders. Kazakhstan Launches Alem Crypto Fund with Binance Kazakhstan for Strategic Digital Asset Reserves

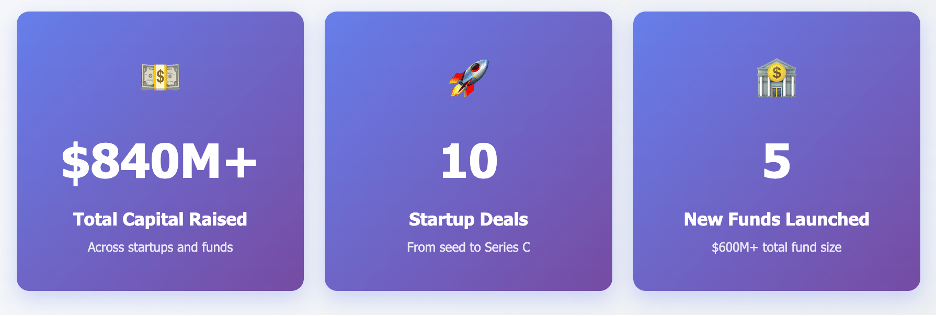

UAE-based BECO Capital, one of MENA's earliest VCs founded in 2012, has closed a $370 million dual-fund raise, including $120 million for BECO Fund IV targeting early-stage tech startups from Pre-Seed to Series A in sectors like fintech, proptech, construction tech, consumer/retail tech, and AI/software, with a focus on UAE and Saudi Arabia. The $250 million Growth Fund, led by Amer Alaily, will invest average tickets of $20 million in Series B to pre-IPO scale-ups to address the region's growth-stage capital gap, expanding BECO's assets under management to over $820 million and supporting Gulf founders building globally competitive technology companies. This initiative reinforces VC activities in MEA emerging markets by backing category-defining startups like Careem, Property Finder, and Kitopi from inception through IPO. BECO Capital closes $370 million dual-fund raise to back Gulf founders

Saudi Arabia-based Sukna Capital has partnered with global credit manager Partners for Growth (PFG) to launch a $50 million specialty lending initiative targeting high-growth tech companies and SMEs across Saudi Arabia and the broader MENA region. The initiative, through Sukna's Sharia-compliant Sukna Fund for Direct Financing (SFDF)—the Kingdom's first open-ended direct lending fund—provides non-dilutive financing options such as working capital lines, term loans, and contract financing to help founders preserve equity and scale sustainably. This collaboration supports Vision 2030 goals by accelerating innovation in emerging markets through flexible, asset-backed credit aligned with revenues and assets. Sukna Capital, Partners for Growth launch $50 million lending initiative to back MENA tech growth

UAE-based Iliad Partners has completed the second close of its $50 million Iliad Fund, targeting early-stage B2B software startups in fintech, logistics, and other digital transformation verticals across MENA. The fund, following an initial $20 million first close, aims to bridge funding gaps for innovative tech companies in emerging markets, with investments ranging from $1-5 million. This milestone reinforces growing VC infrastructure in the region to support scalable software solutions. Iliad Partners completes second close of $50 million fund targeting MENA startups

Saudi Arabia's Cultural Development Fund and Merak Capital have launched an USD 80 million private equity fund targeting the fashion sector, with a focus on growth-stage companies and Saudi brands in apparel, accessories, e-commerce, beauty, and supply chain enablers. The fund emphasizes innovative projects that harness technology and new business models to enhance competitiveness, aligning with Vision 2030 goals to promote innovation and global expansion in cultural industries. This initiative represents VC-like activity in the MEA region, supporting emerging market startups in tech-enabled fashion ventures. Merak Capital Launches USD 80M Fashion Private Equity Fund in Saudi

Sukna Capital and Partners for Growth (PFG) have launched a $50 million financing partnership to support technology firms and small-to-medium enterprises (SMEs) in Saudi Arabia and the broader Middle East, providing non-dilutive, Sharia-compliant financing options such as working capital, contract financing, term loans, and customized credit facilities for growth-stage businesses in innovation and tech sectors. This initiative expands Sukna’s Direct Financing Fund (SFDF), the Kingdom’s first open-ended direct lending fund, allowing founders to preserve equity while accessing revenue- or asset-aligned credit. The partnership leverages PFG’s over 20 years of private credit experience in tech-enabled sectors like fintech and healthcare, aiming to enhance access to institutional-quality credit for Middle Eastern tech startups and SMEs to drive regional entrepreneurship and innovation. Sukna Capital Partners With PFG on $50 Million SME Lending Fund

Events and Competitions

Riyadh will host the Biban Forum 2025 from November 5-8, organized by Monsha'at, expecting over 140,000 visitors from more than 150 countries to foster SME growth and innovation in the MEA region. The event, themed “Global Destination for SMEs,” will feature networking, investment opportunities, and showcases of tech startups, aligning with Saudi Vision 2030 to boost entrepreneurship and VC activities in emerging markets. It builds on previous editions' success in facilitating billions in deals and international partnerships. Riyadh to host Biban Forum 2025, attracting 140K visitors from 150+ countries

Dubai's Expand North Star, the world's largest event for startups and investors since 2016, has facilitated multi-million-dollar investments for thousands of digital startups, including Nigerian mobility fintech Moove raising over $460 million from investors like Uber and BlackRock to expand into 13 global markets, and Indian firms like Freshcraft Technologies ($12.7 million in 2022) and Zaara Biotech ($10 million for UAE operations). The 2025 edition, marking its tenth anniversary from October 12–15 at Dubai Harbour, continues to connect innovators with capital in the MEA region, supporting early-stage ventures such as ShopDoc ($1.36 million) and Machbee Innovations ($1.1 million), while enabling international expansion for emerging market tech firms like UK-based Lorien Finance into the Middle East. Organized by Dubai World Trade Centre and hosted by Dubai Chamber of Digital Economy, the event reinforces Dubai's role as a gateway for VC activities and scaling in emerging markets. Dubai marks 10 years of Expand North Star with record global participation

The Women in Tech Startup Competition Middle East 2nd Edition 2024 targets women-led tech startups in countries including Saudi Arabia, UAE, Egypt, and others, focusing on sustainable tourism innovations across categories like edtech for workforce upskilling, greentech for emissions reduction, and digital technologies such as AI, AR/VR, fintech, and blockchain to drive prosperity. Despite 57% of STEM graduates in the Middle East being women and 34% of tech startups founded by women, they receive only 2.2% of global venture capital funding, highlighting the need for investor empowerment in line with initiatives like Saudi Arabia's Vision 2030 to boost women's participation in emerging markets. The competition offers mentorship, networking, and exposure at events like the UN Tourism Tech Adventure, aiming to connect startups with potential VC opportunities and foster scalable growth in the MEA region's entrepreneurial ecosystem. Women in Tech Startup Competition Middle East 2nd Edition 2024

Acquisitions and Partnerships

Careem, a prominent tech mobility platform in the MEA region, has acquired a minority stake in UAE-based startup Swapp, a digital car rental and subscription service, to deepen their 2022 partnership and expand innovative features like instant onboarding, one-hour deliveries, and EV options within the Careem Everything App. This strategic investment supports Swapp's growth in the emerging UAE car rentals market, projected to reach $223M by 2030 with strong online sales, by leveraging Careem's ecosystem for regional expansion and flexible rental solutions. The move highlights increasing VC-like activities in MEA tech startups focused on digital mobility and fintech integration. Careem acquires minority stake in Swapp, doubling down on car rentals

Ecosystem and Reports

Egyptian startups, particularly in tech and fintech sectors, have attracted $2.2 billion in venture capital investments since 2020, marking a sevenfold increase compared to the 2015-2019 period and demonstrating robust VC activity in the MEA region's emerging market. Despite economic challenges, the sector saw $254 million in investments during the first eight months of 2025, a 17% rise in deal numbers year-over-year, while contributing to around 500,000 direct and indirect jobs and promoting knowledge- and technology-based growth. Government initiatives, including over 70 incentive policies, an electronic registration platform, unified financing for over 5,000 startups, and a forthcoming guide for 14 high-growth sectors, aim to support international expansion and participation in public projects, with a focus on empowering women economically and enhancing social and environmental impact. Egyptian startups attract $2.2bln in venture capital investments since 2020: Al-Mashat

Kazakhstan is actively developing a venture ecosystem to position itself as a platform for innovative startups and global technology companies, including necessary infrastructure and regulatory frameworks to support growth and access to venture funding, as stated by Stanford University professor and venture capital expert Ilya Strebulaev at the Digital Bridge 2025 forum in Astana. Strebulaev emphasized the importance of global venture capital extending to regions like Central Asia and maintaining a venture mindset among entrepreneurs in emerging markets. He highlighted U.S. statistics showing that seven of the world's ten largest companies originated from venture capital and proposed that Kazakhstan has the potential to become a birthplace for future global giants within the next 20 years. Kazakhstan cultivates startup and venture capital ecosystem - Stanford expert

🌍 Global Tech & VC Pulse

This week marked a defining inflection point for global tech and venture capital — the week AI moved from the cloud to our faces, regulators got teeth, and capital shifted from hype to hard assets.

🚀 Big Capital Plays

EA Goes Private ($55B): PIF, Silver Lake, and Affinity Partners take Electronic Arts private — a sign of sovereign wealth and PE capital reshaping big tech toward long-term IP and patient growth.

TikTok (U.S.) Divested ($14B): Oracle, Silver Lake, and MGX acquire TikTok’s U.S. arm under national security orders — a landmark for tech nationalism and data sovereignty.

Figure AI ($1B+ Series C): Backed by NVIDIA and Intel Capital, humanoid robotics officially joins the major investment leagues.

SpaceX ($17B Spectrum Buy): Moves to own the full stack of satellite connectivity with “Direct to Cell.”

Judi Health ($400M Series E): Validates the rise of applied AI in complex healthcare systems.

🧠 1. AI Everywhere: From Cloud to Face

Meta’s Orion AR glasses, Google’s Pixel 10 with Magic Cue, and Qualcomm’s Snapdragon 8 Elite signal a full pivot to on-device AI.

The new AI paradigm = faster, private, cheaper computing at the edge.

The next platform war: Reality OS (Meta) vs Android AI (Google).

Startups should think “edge-native,” not “cloud-first” — privacy-by-design is now a moat.

💼 2. Titans Reshape Strategy

Intel + NVIDIA alliance: Historic co-opetition merges CPU and GPU strengths to dominate AI computing.

EA take-private: The era of “patient capital” is here — sovereign funds are now active tech power brokers.

A new exit path emerges: PE-led strategic acquisitions over IPOs.

⚖️ 3. The Great AI Correction

California’s NeuroRights Act protects brainwave data; Safe & Responsible AI Law enforces deepfake labeling, audits, and bias transparency.

FTC fines ($500M) mark the first major enforcement wave under Operation AI Comply.

Compliance now defines valuation — startups need provable data provenance and “clean” model pipelines.

Expect the rise of RegTech for AI and the Chief AI Ethics Officer.

💸 4. VC’s New Playbook

Global VC hits $364B, but 50%+ now flows into applied AI — not foundation models.

Focus: domain-specific ROI and workflow integration over raw innovation.

Acqui-hires surge amid the AI talent war.

Capital concentrates in mega-rounds, leaving early-stage founders fighting for liquidity.

🌐 5. Tech Nationalism Gets Real

TikTok’s forced sale sets a global precedent for sovereign tech control.

$100K H-1B fee triggers U.S. talent shock — expect accelerated R&D migration to Canada, UK, and Germany.

“Made in America” becomes an investable narrative in deep tech, semiconductors, and secure AI infrastructure.

📈 6. IPOs Reopen — Selectively

Fermi REIT IPO (+55%) shows public markets favor AI infrastructure, not consumer apps.

SPACs resurface for deep tech (e.g., Kodiak AI).

“Picks and shovels” win — not software unicorns.

Liquidity crunch looms for 2021-vintage startups awaiting exits.

💡 Key Takeaway:

2025’s AI boom is maturing fast — from speculative sprints to structural shifts. Edge AI, compliance, and sovereign capital are rewriting the global tech playbook.

🎙️Episodes Recap:

In this episode of The CTO Show with Mehmet, I sit down with Lori Crooks, CISSP, CISA, CISM , CEO of Cadra, to explore the evolving world of compliance and cybersecurity. From FedRAMP and SOC 2 to the latest AI regulations, Lori breaks down why compliance matters, where companies often go wrong, and how startups can use compliance as a competitive advantage.

In this episode of The CTO Show with Mehmet, I sit down with Steve Fultz, PhD and Melissa Huff Fultz — founders of The Fultz Group, authors of Family Business Facelift, and consultants helping family businesses unlock hidden revenue and embrace digital transformation.

🎙 Sponsor This Newsletter & Podcast

Reach founders, tech leaders, and investors across MENA and beyond through this newsletter and The CTO Show with Mehmet. Let's Talk

📖 From Nowhere to Next

Every week I share startup lessons and stories through The CTO Show Brief. But if you want to go deeper, my book From Nowhere to Next brings together the experiences and insights that shaped my own journey.

Thanks for reading — and for being part of this growing, global-minded network.

— Mehmet