Welcome to Issue 143 of The CTO Show Brief!

The global tech landscape is splitting across two fault lines: the rise of sovereign AI empires and a hard reset toward foundational infrastructure. Governments are pouring billions into national compute—from the U.S. DOE’s 100,000-GPU initiative to Saudi Arabia’s 200-MW AI hub—while capital concentrates in deep infra plays like Crusoe Energy’s $1.38B raise. Meanwhile, the broader startup ecosystem faces its weakest funding environment since 2017. Yet MEA momentum continues, with Saudi crossing $1B in VC investment and Gulf regulators paving the way for unicorn IPOs.

Whether you’re one of our 2,9011 subscribers or a first-time reader—grab your coffee, and let’s dive into what’s shaping tech and venture this week!

MEA Tech & VC Roundup

STRATEGIC FUNDING ACTIVITY: DIVERSIFICATION BEYOND FINTECH

The region's funding landscape this week reveals a deliberate pivot toward infrastructure-enabling technologies, marking a maturation beyond the fintech-dominated narrative of 2022-2024. We're witnessing capital flow into the foundational layers that will support the next decade of digital transformation.

· Construction & Proptech Momentum: Saudi construction tech Brkz secured $30 million in debt financing from Stride Ventures to scale project management platforms, while Lebanese proptech Karm raised EUR 5 million from Eurobank to expand into Cyprus. These deals signal growing investor confidence in digitizing traditionally offline, capital-intensive industries—sectors where technology adoption curves remain steep but total addressable markets are massive.

· Enterprise Infrastructure Gains Traction: UAE's UnifyApps closed a $50 million Series B for generative AI enterprise software, and Egyptian AI infrastructure player MidLyr raised $2.5 million to expand cloud services across MENA. The common thread: B2B infrastructure that enables other companies to scale, positioning these firms as the 'AWS layer' for regional digital transformation.

· Fintech Valuations Hold Strong: UAE-based Tabby's secondary sale at a $4.5 billion valuation provides a critical data point—fintech winners in MENA can command valuations competitive with global peers, offering early investors liquidity while the company remains private. This validates the region's ability to produce genuine breakout companies.

· Logistics & AI Automation: Egyptian logistics platform Logexa raised $2 million in pre-Series A from Seedra Ventures, while South African AI startup Velents secured $1.5 million to launch Agent SA for business automation. Both plays address acute pain points in emerging markets: inefficient supply chains and manual business processes that AI can optimize at scale.

· Additional Notable Deals: South African digital marketplace Markets raised ZAR 12.9 million to expand into additional African markets. Saudi insurtech Najeebai closed pre-seed funding for AI-powered personalized insurance products. UAE HR tech Squadio raised $3 million to expand its AI-driven remote hiring platform in Saudi Arabia. UAE AI firm RMZAI raised $100,000 in pre-seed from BeyondXYZ for real-time analytics in logistics optimization.

VC FIRM EVOLUTION: REGULATORY MATURATION UNLOCKS SCALE

This week's flurry of regulatory milestones and institutional fund launches represents a structural shift in how capital will be deployed across MEA for the next decade. We're moving from boutique, founder-friendly checks to institutionalized capital pools with genuine dry powder.

· Saudi Arabia's Regulatory Push: Hala Capital launched as a CMA-licensed private capital firm, while VC firm HALA obtained full licensing as a private fund manager. These regulatory stamps aren't bureaucratic box-checking—they're prerequisites for deploying substantial capital from institutional LPs and sovereign wealth funds who require regulated counterparties.

· Banking Sectors Enter Venture: UAE's Commercial Bank International launched CBIX, a corporate venture capital arm targeting fintech and digital banking innovation. When regional banks deploy venture capital arms, it signals mainstream acceptance of startup ecosystems as strategic innovation channels, not speculative side bets.

· Global Capital Flows Inbound: Insight Partners' investment in Saudi's 3Ventures Group to boost the local tech ecosystem demonstrates that tier-one global VCs now view the region as a must-have portfolio allocation. This isn't impact investing—it's strategic positioning in a high-growth geography.

· Specialized Fund Deployment: Egyptian VC The Lab Ventures closed its second fund targeting $50 million for MENA B2B tech, specifically prioritizing SaaS and enterprise solutions. The vertical specialization indicates funds are now hunting specific theses rather than generalist "MENA tech" mandates.

STRATEGIC PARTNERSHIPS: ECOSYSTEM ORCHESTRATION AT SCALE

The sovereign-VC-corporate partnership model pioneered in the Gulf is accelerating, creating coordinated pushes toward strategic priorities like AI and public market readiness.

· Vision 2030 AI Acceleration: Saudi's Public Investment Fund and Aramco partnered with AI accelerator Humain to advance national AI goals, committing to fund and mentor 50+ startups. This isn't passive capital—it's active industrial policy using venture as a tool for national technology leadership.

· IPO Pipeline Development: Saudi startups are preparing for public market debuts as VC investments surpass $1 billion in 2025, with Tadawul streamlining tech listings. Several unicorns are reportedly in late-stage IPO preparation, which would mark the region's first genuine venture-backed tech IPOs and create demonstration effects for the entire ecosystem.

· Cross-Border M&A Emergence: UAE healthtech ORA acquired Moroccan startup Cathedis to expand telemedicine across North Africa. Strategic M&A between MEA companies—rather than exits to U.S. or European acquirers—signals regional consolidation and the emergence of category-defining regional champions.

· Ecosystem Activation Events: Over 100 Turkish and regional startups pitched at a high-profile Antalya investment event, securing initial VC and corporate commitments. Turkey is positioning itself as a bridge between MEA and European tech ecosystems, particularly for deep tech and hardware.

Global Tech & VC Pulse

THE SOVEREIGN COMPUTE WARS: NATIONS BUILD AI EMPIRES

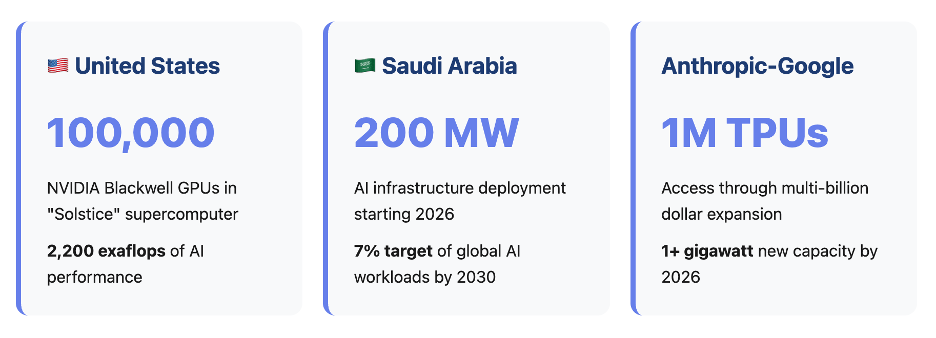

The abstraction of AI dominance has crystallized into concrete reality: whoever controls massive-scale specialized compute controls economic and geopolitical power. This week's announcements reveal a new global map being drawn in real-time. The United States made its most aggressive move yet with the Department of Energy's landmark public-private partnership with NVIDIA and Oracle to build two next-generation AI supercomputers at Argonne National Laboratory. The flagship "Solstice" system will deploy 100,000 NVIDIA Blackwell GPUs—the largest AI supercomputer in the DOE complex—alongside a 10,000-GPU "Equinox" system. Together, they'll deliver 2,200 exaflops of AI performance explicitly framed by the administration as essential to "winning the AI race."

Saudi Arabia unveiled a parallel bid to become a global AI hub through HUMAIN's collaboration with Qualcomm Technologies, deploying 200 megawatts of advanced AI infrastructure starting in 2026. This is a full-stack sovereign play combining HUMAIN's Arabic multimodal LLMs (ALLaM) with Qualcomm's AI200 and AI250 rack-scale solutions, emphasizing inference optimization—the process of running trained models at scale. The Kingdom aims to capture 7% of global AI workloads by 2030, positioning itself as the world's inference provider. Anthropic's landmark Google Cloud expansion—valued at "tens of billions of dollars" for access to up to one million TPUs—underscores that access to state-of-the-art compute is now the primary bottleneck for frontier AI innovation. The deal brings over a gigawatt of new capacity online by 2026, with Anthropic explicitly citing TPU price-performance as decisive.

AI SHIFTS FROM APPLICATION TO OPERATING SYSTEM

The competitive frontier is migrating from discrete chat applications to deeply embedded, context-aware agents functioning as a native OS layer. Value is moving from models themselves to seamless, reliable, secure integration into everyday workflows. OpenAI's acquisition of Software Applications Inc. (SAI), developer of the Mac app "Sky," reveals its long-term vision. Sky isn't a ChatGPT wrapper—it's a "powerful natural language interface for the Mac" designed to "understand what's on your screen and can take action using your apps." This is agentic AI: systems that perceive context and execute tasks on behalf of users.

Mistral AI launched "Mistral AI Studio" targeting the enterprise challenge of moving from prototypes to production-grade systems. Built on three pillars—observability (tracing and monitoring), agent runtime (stateful workflows), and AI registry (centralized governance)—the platform addresses the reality that for enterprises, the AI model is just one component. The real challenge lies in operationalizing AI with the same rigor as mission-critical software. Simultaneously, Mistral's launch reveals an emerging software stack for enterprise-grade agentic AI—a new "AgentOps" or "AIOps" category analogous to DevOps and MLOps. Gartner identifies "Agentic AI" as the top 2025 technology trend but notes it requires robust guardrails. This creates greenfield opportunities for tools managing agent monitoring, securing agent actions, managing costs, and ensuring regulatory compliance.

SEMICONDUCTOR CONSOLIDATION: THE $22B SKYWORKS-QORVO MERGER

Skyworks Solutions' $22 billion acquisition of Qorvo marks a defining signal of maturation in the radio frequency (RF) semiconductor segment. Driven by slowing smartphone growth, price pressure from Chinese competitors, and high innovation costs, the deal aims to build a scaled U.S. champion capable of competing globally across mobile, automotive, defense, and AI data center markets. The cash-and-stock transaction creates a combined entity with $7.7 billion in pro forma annual revenues, 8,000+ engineers, and 12,000+ patents. The companies project over $500 million in annual cost synergies within three years through optimized factory utilization, consolidated R&D, and streamlined operations. The strategy combines a formidable $5.1 billion mobile business with a $2.6 billion "Broad Markets" platform diversifying into defense, edge IoT, and AI data centers—crucial as the core mobile handset market faces "persistent challenges" and "eroded profitability."

THE GREAT REBALANCING: AI TRANSFORMS THE LABOR MARKET

The tech labor market is undergoing structural transformation, not cyclical downturn. AI adoption simultaneously drives mass layoffs in established roles and creates intense demand for specialized AI-native talent, permanently reshaping career paths and corporate human capital strategies. 2025 has seen 202,000+ global tech layoffs, with executives explicitly citing AI and automation as primary drivers. Amazon cut 14,000 corporate staff linked to "AI-driven processes," Salesforce eliminated 4,000 customer support jobs with CEO Marc Benioff stating AI automation meant he needed "fewer heads," and Accenture reduced headcount by 11,000 citing automation. For many displaced workers, "reskilling is not helping this time," indicating permanent role elimination rather than temporary displacement. In parallel, companies are creating entirely new job categories: Knowledge Architect (structuring AI agent information), AI Conversation Designer (shaping AI interface personality and flow), AI Ethicist/Responsible AI Architect (governance and bias prevention), and Human-AI Collaboration Lead (defining human-AI team workflows). These roles demand new skill blends combining deep technical acumen with communication, domain expertise, and strategic thinking. A critical challenge emerges at the entry level. AI excels at automating routine tasks—summarizing meetings, cleaning data, drafting basic code—that historically served as the training ground for junior workers. This "cannibalization" creates a paradox: entry-level jobs now require experience those same roles no longer provide. Without these foundational "task rungs," the climb up the opportunity ladder steepens, potentially creating a long-term talent pipeline crisis.

VC MARKET BIFURCATION: MEGA-ROUNDS FOR AI, CAUTION ELSEWHERE

The late 2025 venture landscape is sharply bifurcated—a "barbell" dynamic where torrents of capital flow into AI mega-deals at soaring valuations while the broader ecosystem faces capital constraint, slumping fundraising, weak exits, and renewed discipline. The Q3 2025 PitchBook-NVCA Venture Monitor data is definitive: AI accounts for a record 39.5% of all venture deal count and a staggering 55.2% of year-to-date deal value. Nearly all billion-dollar-plus mega-rounds focus on AI. Meanwhile, overall VC fundraising continues slumping with just $45.7 billion raised through Q3—on track for the lowest annual total since 2017. Exit activity remains weak, preventing capital recycling back to LPs and into new funds, leading VCs to seek alternative liquidity through secondary sales and continuation vehicles. Crusoe Energy's $1.38 billion Series E at over $10 billion valuation perfectly illustrates capital deployment. Co-led by Mubadala Capital and Valor Equity Partners with strategic investment from Nvidia, the funding will acquire advanced hardware and accelerate buildout of large-scale, energy-efficient AI data centers. Crusoe is building a 1.2-gigawatt campus in Texas for OpenAI alone—a $12 billion single project. The company's business model requires securing massive energy resources (45+ GW pipeline) and managing vertically integrated construction and operations. This returns to a classic venture strategy: providing overwhelming financial firepower to build capital-intensive infrastructure creating deep, defensible moats. Building AI data centers is extraordinarily expensive, making the venture game for AI infrastructure look more like private equity or industrial project finance than traditional software investing, with different risk profiles, capital requirements, and return expectations. For startups outside the AI halo, the market is becoming fundamentally more difficult. A "flight to quality" creates a potential survival crisis. The combination of low VC fundraising, a closed exit window, and intense capital concentration in AI means non-AI companies must operate under a new, more disciplined playbook focused on survival and capital efficiency. The bar for "venture-backable" businesses outside AI has been permanently and significantly raised.

GTM Operator's Take

We are entering a bifurcated market cycle: sovereign AI build-outs, critical digital infrastructure, and enterprise AI platforms are pulling capital, talent, and policy support toward them, while the rest of the ecosystem transitions into a discipline-first environment. In MEA, regulatory maturity and sovereign strategy are formalizing the region’s venture fabric — drawing global allocators and creating real institutional pathways for founders aligned with national priorities. At the same time, the AgentOps layer is emerging as the next major enterprise software category as organizations move beyond experimentation and begin operationalizing AI at scale. For founders outside the AI gravity well, runway discipline, profitability visibility, and capital-efficient execution aren’t defensive moves — they are the new baseline for credibility. Those who adapt early will define the next era of durable value creation.

🎙️Episodes Recap:

In this episode, Mehmet sits down with Artur Rivilis , CTO of Augment, to explore how AI is moving beyond copilots and into the era of AI teammates — intelligent agents that think, act, and collaborate like humans. Art shares his journey from immigrant engineer to CTO, the lessons learned through two major acquisitions (Shopify and Flexport), and what it really takes to lead engineering teams through hypergrowth and M&A.— move from chaos to focus by simplifying what matters most.

Tourism is becoming a strategic economic engine for cities like Dubai, Singapore, Riyadh, and Milan. But one massive gap has been untouched: tax-free shopping. Every year, billions in VAT refunds leave local economies instead of being reinvested into retail and travel ecosystems. Ameer Jumabhoy, Co-Founder & CEO of Utu, is changing that.

In this episode of The CTO Show with Mehmet, we sit down with Ahmed Bahgat , a leading IT expert, digital forensics specialist, and court-appointed arbitrator who has handled 600+ cyber and technology-related cases across the UAE, GCC, and Canada. From cyber breaches and data leaks to AI deployment disputes and cryptocurrency investigations, Ahmed shares real-world insights into modern digital crime — and how organizations should protect themselves before it’s too late.

🎙 Sponsor This Newsletter & Podcast

Reach founders, tech leaders, and investors across MENA and beyond through this newsletter and The CTO Show with Mehmet. Let's Talk

📖 From Nowhere to Next

Every week I share startup lessons and stories through The CTO Show Brief. But if you want to go deeper, my book From Nowhere to Next brings together the experiences and insights that shaped my own journey.

Thanks for reading — and for being part of this growing, global-minded network.

— Mehmet