Welcome to Issue 145 of The CTO Show Brief!

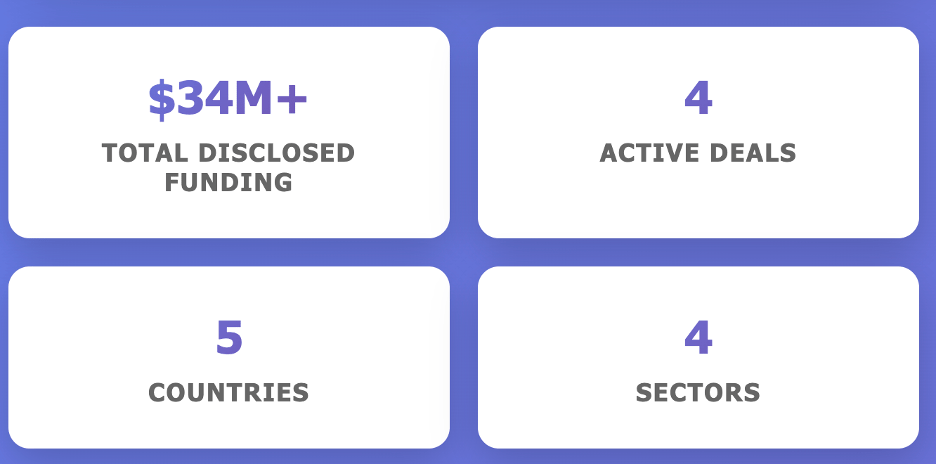

The MEA ecosystem is moving with real momentum this week, with Saudi Arabia and the UAE pushing forward across fintech, contech, AI learning, and next gen HR tech. From Builtop’s $11M raise in Saudi construction to DataCamp entering the UAE through acquisition, the region continues to attract focused capital and build AI-first infrastructure. At the same time, global tech and venture markets are sending a very different signal. Public markets are jittery, but private markets are doubling down on AI agents, quantum hardware, and strategic acquisitions at record speed. The gap between sentiment and conviction has never been wider.

Whether you’re one of our 2,833 subscribers or a first-time reader—grab your coffee, and let’s dive into what’s shaping tech and venture this week!

MEA Tech & VC Roundup

Funding Rounds & Investments

Builtop, a Saudi digital procurement startup founded in 2024, raised $11 million in funding led by TAM Capital to provide embedded finance solutions like "pay-later" trade credit for construction and real estate sectors. The investment will support expansion across Saudi Arabia, AI enhancements, and alignment with Vision 2030 infrastructure projects to improve cashflow and procurement efficiency. This funding highlights VC interest in fintech startups targeting emerging markets in the MEA region, particularly in Saudi Arabia's construction industry. Wamda - TAM Capital leads $11M round in Builtop

Saudi-based Workey, a business solutions platform founded in 2024, has secured an undisclosed investment from Falak Investment Hub to support its official launch and development of AI-driven tools and custom investor solutions. The platform offers digital bookings for offices, meeting rooms, and event spaces across over 200 locations in Saudi Arabia, along with access to verified service providers and support for startups and foreign investors. This partnership aims to strengthen Saudi Arabia’s business solutions ecosystem and enable regional expansion. Wamda - Falak backs Workey

Petal Group, a UAE and Ireland-based floral gifting and e-commerce platform, has secured $18 million from Quintas Capital to fuel its international expansion, focusing on strategic acquisitions and new market entries within the Irish–Middle East investment corridor. The funding supports growth in the UAE and Ireland, where the company operates brands like Flowers.ie and Flowers.ae, leveraging a proprietary tech platform for premium floral design and same-day delivery. Wamda - Petal Group secures $18M

Nigeria-based music streaming service Hafrikplay is raising a $5 million Series A funding round, expected to close in the first quarter of 2026, to support its expansion across Africa. The company is also pursuing a partnership with telco MTN Nigeria. Music Ally - Hafrikplay to raise $5M

VC Fund Launches

Binbar Investment and Joa Capital have partnered to launch the $133 million Marhoon Fund, Saudi Arabia’s first direct financing fund secured by lease and usufruct contracts, aimed at providing innovative financing solutions backed by operational assets to support private sector growth and funding diversification in line with Vision 2030. The fund targets Saudi companies, leveraging the growing leasing market with over 1.5 million documented agreements and standardized digital contracts that enhance transparency and serve as collateralizable assets. Joa Capital, a Saudi-based private markets firm investing in high-growth tech companies across the MENA region, acts as a key partner in this initiative. Wamda - Binbar, Joa Capital launch $133M Marhoon Fund

Acquisitions & Expansions

DataCamp, a US- and London-based edtech platform for data and AI skill building, has acquired UAE-based Optima, an AI-native learning platform founded in 2023 that personalizes lessons and focuses on teaching data and AI skills to enterprises and individuals. This marks DataCamp's first major expansion into the Middle East, integrating Optima's adaptive technology into its platform and launching free access to over 500 courses for UAE educators and students through DataCamp Classrooms. The acquisition aligns with the UAE's National Strategy for Artificial Intelligence 2031, aiming to upskill the local workforce amid growing demand from global enterprises. Wamda - DataCamp enters Middle East with Optima acquisition

Saudi Arabia-based contech firm WakeCap has acquired Brazil’s Trackfy, a workforce safety and operational intelligence platform, to expand into Latin America and establish Brazil as its new regional headquarters. The acquisition extends WakeCap’s platform beyond construction into operations and maintenance, enabling clients to manage projects through the full facility lifecycle. This move aligns with WakeCap’s recent $28 million funding to enhance AI-driven construction solutions and global reach. Wamda - WakeCap acquires Trackfy

Startup Launches

Noum, a UAE-based HR tech company founded by Sarkis Atanesov, has launched an AI-driven platform to transform hiring processes in the GCC by promoting skills-first hiring amid reported skill shortages and planned recruitment growth. The platform streamlines the end-to-end hiring cycle, including role planning, interviewing, analysis, and feedback, aligning with Dubai's economic vision and reports on future jobs emphasizing tech-based tools and reskilling. It supports high-growth companies in the region with modular architecture and fast onboarding to enhance talent decisions and candidate experiences. Wamda - Noum launches in UAE

Competitions & Awards

Four startups from Australia, India, and the UAE—Halo AI, Heatseeker, Sravathi AI, and Without—were crowned winners of L'Oréal's 2025 SAPMENA Big Bang Beauty Tech Innovation Program, the largest open innovation competition in the South Asia Pacific, Middle East, and North Africa (SAPMENA) region, focusing on beauty tech solutions in areas like consumer experience, content & media, and tech for good. These startups, drawn from SAPMENA's dynamic ecosystem of large populations, rising middle classes, and digitally-savvy youth, will collaborate with L'Oréal on commercial pilots, gain exposure to 35 markets, and receive year-long mentorship from executives at L'Oréal and partners like Google and Meta. The program underscores the region's growing role as a hub for beauty tech innovation, with winners addressing challenges such as AI-driven influencer matching, real-time market experiments, drug discovery, and sustainable waste recycling. Bastille Post - L'Oréal Beauty Tech winners

Trends & Insights

The UAE's real estate market, which saw over 125,000 transactions worth AED 431 billion in the first half of 2025, remains reliant on outdated brokerage systems despite the country's AI-forward policies, prompting a shift toward AI-native models that integrate generative AI for data processing, seller acquisition, buyer management, and deal finalization to enhance transparency and efficiency. This evolution positions the UAE—bolstered by initiatives like the Dubai REST app and the National Strategy for Artificial Intelligence 2031—as a leader in embedding AI at the core of property transactions, moving beyond proptech digitization to collaborative human-AI ecosystems. While the article focuses on the UAE, it highlights opportunities for broader adoption in emerging markets through intelligent infrastructure, though it does not explicitly discuss VC activities or specific tech startups. Wamda - UAE’s next property boom powered by AI

Global Tech & VC Pulse

While public markets convulsed over AI bubble fears this week—with tech stocks suffering their worst day in a month—the private markets told a completely different story. Anysphere raised $2.3 billion at a $29.3 billion valuation for its Cursor coding platform, Salesforce dropped $100 million on a year-old AI startup, and IBM publicly committed to delivering quantum advantage by 2026. This isn't volatility. This is a fundamental decoupling of public sentiment from private conviction.

The question isn't whether AI is overhyped. The question is whether you're betting on the infrastructure that survives the shakeout.

Public Markets Blink First

The Nasdaq dropped 3.04% this week, with AI darling Nvidia falling 3.6%. The catalyst? A toxic cocktail of stretched valuations, SoftBank selling its entire Nvidia stake, and macro uncertainty as delayed economic data hits the pipeline.

CBS News dusted off the dot-com bubble playbook. Comerica's Eric Teal pointed out tech stocks are trading 45% above the rest of the market's forward multiples. The "Magnificent 7" now represent 37% of the S&P 500's total value—an unprecedented concentration that has investors nervous.

But here's the disconnect: Unlike Pets.com, today's AI leaders have real fundamentals. Nvidia's revenue more than doubled to $130 billion last fiscal year, and its P/E ratio is roughly half what tech giants commanded in the late '90s. The problem isn't that AI will fail. It's that the gains are so consolidated into so few companies that everyone else is getting left behind.

The $2.3B Counter-Signal: Anysphere Rewrites the Playbook

If public markets are having a crisis of confidence, someone forgot to tell Anysphere. The Cursor parent company just closed a $2.3 billion Series D at a $29.3 billion post-money valuation—more than 3x what it raised just six months ago.

The investor list reads like a strategic coronation: Accel, a16z, Thrive, DST, Coatue, plus the two most important names in AI—Nvidia and Google. When bitter rivals both write checks, you're looking at platform-level infrastructure, not another wrapper.

This wasn't the week's only mega-deal. Defense tech startup Chaos Industries raised $510 million at a $4.5 billion valuation for counter-drone systems. The market has gone full barbell: billion-dollar platform bets at the top, healthy but orders-of-magnitude-smaller rounds everywhere else.

.

Giants Buy Brains: The Acqui-Hire Arms Race

While Anysphere represents the mega-round end of the market, a parallel M&A pattern emerged this week: strategic acqui-hires for pure agentic AI capability.

Salesforce acquired Doti AI for ~$100 million. The Israeli startup is one year old and had raised just $7 million in seed funding. What did Salesforce buy? Doti's "Organizational Brain"—an agentic search layer that unifies all company data and deploys it intelligently in Slack. As Slack CEO Denise Dresser put it, this "fast-tracks our vision to reinvent enterprise search."

AMD acquired MK1, an AI software startup founded by Neuralink veterans, to get its high-speed inference stack optimized for AMD hardware. This is AMD's CUDA counter-punch—and it was cheaper to buy than to build.

Cadence acquired ChipStack, an AI2 Incubator grad building AI agents for chip verification, one of the biggest bottlenecks in semiconductor design.

These aren't product acquisitions. They're capability acquisitions. For a $100 billion company, it's strategically cheaper to pay $100 million for a one-year-old team than to risk the 18-24 months it would take to build that capability in-house—especially when competitors might beat you to it.

From Models to Agents: The Value Migration

The market's focus is shifting hard from "generative" (making things) to "agentic" (doing things). Two developments this week crystallized the trend.

Genspark, an "AI agent builder" platform, hit a $1 billion+ valuation on a $200M+ Series B. The company specializes in building autonomous agents that handle complex, multi-step tasks like planning, coding, and deployment—not just answering prompts.

Meanwhile, Remini—the AI photo enhancer owned by Bending Spoons—hit 1.16 million weekly installs after integrating Google's new "Nano Banana" (Gemini Flash Image) model. The critical point: Remini's viral surge came from using an efficient, third-party model via Vertex AI, not building its own. This directly addresses a core problem identified in SVB's State of the Markets report—AI companies don't run efficiently because compute costs kill margins.

The bifurcation is clear:

Generative AI is maturing into a commodity. Speed and efficiency matter more than model size.

Agentic AI is the new high-margin value layer, where all the venture capital is flowing.

Startups are no longer being funded to build better foundational models. They're being funded to orchestrate commodity models into autonomous, task-completing agents.

The Quantum Hardware Race Gets Real

Quantum computing just had its "Netscape moment"—the technology transitioned from physics experiment to product-driven geopolitical race with a sub-3-year horizon.

IBM unveiled its 120-qubit "Nighthawk" processor on November 12 and, more importantly, committed to delivering quantum advantage by 2026 and fault-tolerant quantum computing by 2029. This is the first time a major player has attached a firm C-suite deadline to this milestone.

Three days later, Chinese researchers (CHIPX and Turing Quantum) announced a rival photonic quantum chip claiming 1,000-fold speed gains over leading GPUs for specific tasks. More significantly, they've already built a pilot production line capable of 12,000 wafers annually and are deploying chips in aerospace, biomedicine, and financial modeling.

This dueling-announcement structure changes everything. IBM's 2026 deadline creates a tangible investment horizon for VCs who previously had no clear timeline for returns. China's immediate counter-signal proves this is now a fully-funded, global arms race for computational supremacy.

Google Weaponizes RICO Against Cybercrime

Google filed a federal RICO lawsuit against "Lighthouse," a China-based phishing-as-a-service network that allegedly created 200,000 fraudulent websites in 20 days and compromised between 12.7 million and 115 million US credit cards.

The goal isn't damages—it's an injunction to force domain registrars and web hosts to dismantle Lighthouse's entire infrastructure. This is Big Tech moving from defensive cybersecurity to offensive cyber-warfare using the legal system as a weapon.

By framing Lighthouse as a criminal enterprise under RICO (the law designed to take down the Mafia), Google can attack the entire supporting infrastructure—hosting, domains, payment processors—not just individual attackers.

What This Means

For founders: The era of building general-purpose AI tools is over. The market is rewarding model-agnostic, agentic workflows for specific enterprise verticals. Your exit is a $100M strategic acquisition in 18 months, not a $100M ARR IPO in five years.

For VCs: Stop spray-and-pray AI funding. Execute a barbell strategy: either back capital-efficient generative apps using commodity models, or make massive platform-level bets on agents. The middle is dead.

For incumbents: Public market volatility is noise. The real threats are agentic startups methodically eating your core workflows and new hardware paradigms (quantum, specialized AI chips) rendering your infrastructure obsolete. Your R&D budget is now your M&A budget.

The public markets are pricing in a bubble. The private markets are in a consolidated arms race for the next platform—AI agents, quantum hardware, or the future of software development itself. The era of "all AI is good" is over. The era of strategic, high-stakes consolidation has begun.

And if you're not sure which side of that divide you're on, the market will decide for you.

🎙️Episodes Recap:

Digital transformation isn’t about technology — it’s about leadership, culture, and execution. In this episode, veteran CTO and transformation expert Tory Bjorklund joins Mehmet to debunk hype-driven transformation, explain why most initiatives fail, and share his proven framework for executing technology-driven change that sticks.

In this powerful conversation, Christina Richardson — serial founder, resilience researcher, and founder of Foundology — joins Mehmet to unpack the real psychological journey of entrepreneurship. Christina shares the story behind her 2 AM wake-up call that wasn’t a heart attack but a full nervous system collapse. That moment led her to study over 400 founders, uncover patterns of burnout, and build a framework that helps founders perform at their best without destroying themselves.

In this episode, Luv Kapur joins Mehmet to break down how composability is reshaping modern engineering. Luv is an engineering leader at Bit, working across their open source and enterprise platforms, and one of the earliest advocates for modular, reusable software as a way to unlock scale. They explore why composability matters, how modular systems speed up delivery, and the cultural shift required inside engineering teams. Luv also shares real results from enterprise adoption, including faster iteration cycles, fewer defects, and measurable ROI in the eight-figure range. The conversation closes with a deep look into HopeAI, Bit’s AI architect designed to orchestrate existing components rather than generate endless code.

🎙 Sponsor This Newsletter & Podcast

Reach founders, tech leaders, and investors across MENA and beyond through this newsletter and The CTO Show with Mehmet. Let's Talk

📖 From Nowhere to Next

Every week I share startup lessons and stories through The CTO Show Brief. But if you want to go deeper, my book From Nowhere to Next brings together the experiences and insights that shaped my own journey.

Thanks for reading — and for being part of this growing, global-minded network.

— Mehmet