Welcome to Issue 157 of The CTO Show Brief.

The Infrastructure Reversal

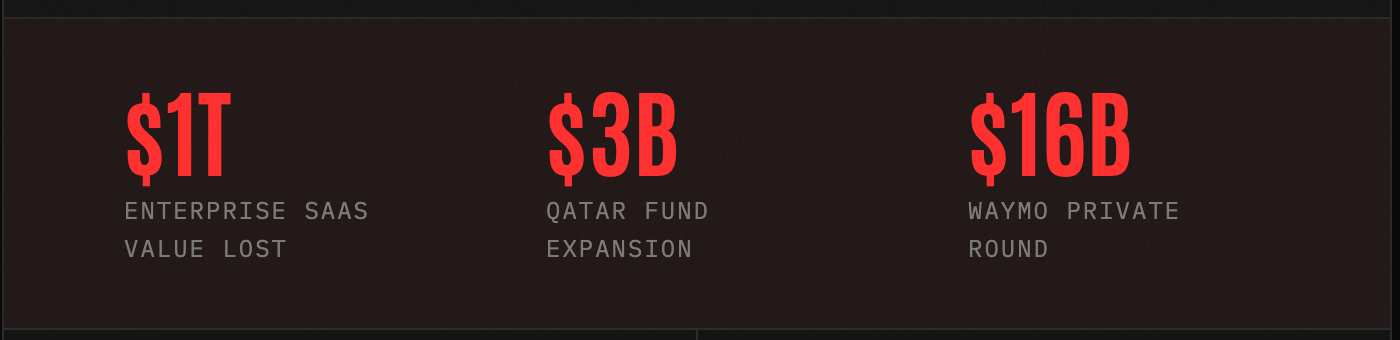

February 2, 2026 marks the week AI collided with its own economics. The theoretical promise of autonomous agents met the operational reality of legacy software pricing, triggering a $1 trillion repricing of enterprise value. Simultaneously, sovereign capital moved from passive LP to active market maker, and the physical bottlenecks of the digital economy became investable at scale.

Seat-based SaaS is dying, outcome pricing is arriving. Snowflake's $200M OpenAI integration and Fundamental's $255M Series A for Large Tabular Models prove agents don't need seats. Enterprise software lost $1T in value as investors realized the fundamental incompatibility: if one AI agent replaces ten employees, customers won't buy ten licenses. The shift is from selling access to selling work. LTMs solve the hallucination problem for structured data, making AI viable for finance and operations, not just marketing. For founders, this means rethinking unit economics entirely. Consumption-based or outcome-based pricing becomes mandatory. For MEA, this is particularly relevant given the region's reliance on tabular-heavy sectors like banking, telecom, and energy.

Regulatory fragmentation creates sovereign opportunity. US federal deregulation collides with aggressive state-level AI laws while Europe considers recalibrating the AI Act. The result: no single compliance regime exists. Qatar responds by tripling its Fund of Funds to $3B and subsidizing compute, effectively treating AI infrastructure as a national utility. Egypt positions itself as Africa's AI hub through connectivity and data sovereignty plays. The splinternet is real, and it creates arbitrage: startups can't launch globally anymore, they launch multinationally with jurisdiction-specific deployments. For investors, regulatory resilience is now a core diligence question.

Ground infrastructure is the new launch. Northwood Space closes $100M Series B and secures $49.8M from the US Space Force to deploy phased-array ground stations in 12 hours instead of months. SpaceX won the upstream battle, the bottleneck is now downlink capacity. As mega-constellations scale, the volume of data generated in orbit vastly exceeds ground station capacity to retrieve it. Defense doctrine shifts to mobile, resilient networks that can be rapidly deployed. The model is vertical integration: hardware that's software-defined wins. MEA's geography and security priorities make it a natural customer and testbed for rapid-deployment connectivity in remote industrial sites and border zones.

Private capital is re-engineering exits. Goldman predicts 2026 could be the biggest M&A year in history, but the real signal is structural: companies like Waymo raise $16B privately, bypassing public market volatility entirely. Sovereign funds aren't just LPs anymore, they're funding secondary platforms and growth vehicles to create liquidity where public markets won't. Qatar's expansion explicitly targets the Series A to C gap, the traditional valley of death. The takeaway for founders: plan for secondary liquidity programs from Series B onwards. M&A readiness is a valid exit strategy in a year where strategic acquirers are buying infrastructure, not just talent.

TechBio moves from research to production. Nvidia partners with Eli Lilly to build an AI drug discovery lab, and an AI-focused biotech files for IPO days after starting Phase 3 trials. The shift is from wet lab experimentation to dry lab simulation. Simulating molecular interactions in silico compresses the 10-year, $2B drug development cycle. Data becomes the moat, not just the molecule. For MEA, this connects to national genomic programs in Saudi Arabia and the UAE. Access to genetically diverse datasets positions the region for pharma partnerships that transfer know-how locally.

AI agents are the new threat vector. Security leaders predict a major enterprise breach by mid-2026 caused fully by autonomous agentic AI. Attackers that don't sleep, don't make typos, and operate at machine speed render human SOC analysts obsolete. The defense shifts to identity-centric zero trust and AI-vs-AI systems. For MEA's energy and financial sectors, which are high-value geopolitical targets, this is urgent. National cyber agencies will mandate AI security standards, creating local demand for defense infrastructure.

The deployment phase has begun. The market is bifurcating into those building the outcome layer and those building the infrastructure that makes outcomes possible. The middle is disappearing.

🎙️Episodes Recap:

In this episode, Mehmet sits down with Tamara Laine , Founder and CEO of MPWR, to explore how AI and agentic systems are reshaping the future of lending. They discuss why traditional credit scores fail gig workers and modern professionals, how alternative data can unlock financial inclusion, and what it really means to build human-centered fintech in an AI-first world. From explainable AI to ethical lending and the future of work, this conversation goes deep into how finance must evolve to serve the new economy.

In this deep and thought-provoking episode, Mehmet sits down with Alessandro Grampa , Founder of Whole Grain Wisdom, to explore what it truly means to be a “Quantum Founder” in the age of AI, hyper-growth, and burnout. From panic attacks and founder stress to meditation, neuroscience, ancient wisdom, and artificial intelligence, Alessandro shares his personal transformation and the framework he now uses to help high performers reconnect with purpose, resilience, and inner coherence. This is not a typical startup conversation. It is a masterclass on conscious leadership, mental resilience, and building meaningful companies without losing yourself in the process.

📖 From Nowhere to Next

Every week I share startup lessons and stories through The CTO Show Brief. But if you want to go deeper, my book From Nowhere to Next brings together the experiences and insights that shaped my own journey.

Thanks for reading — and for being part of this growing, global-minded network.

— Mehmet